CORE FEATURES

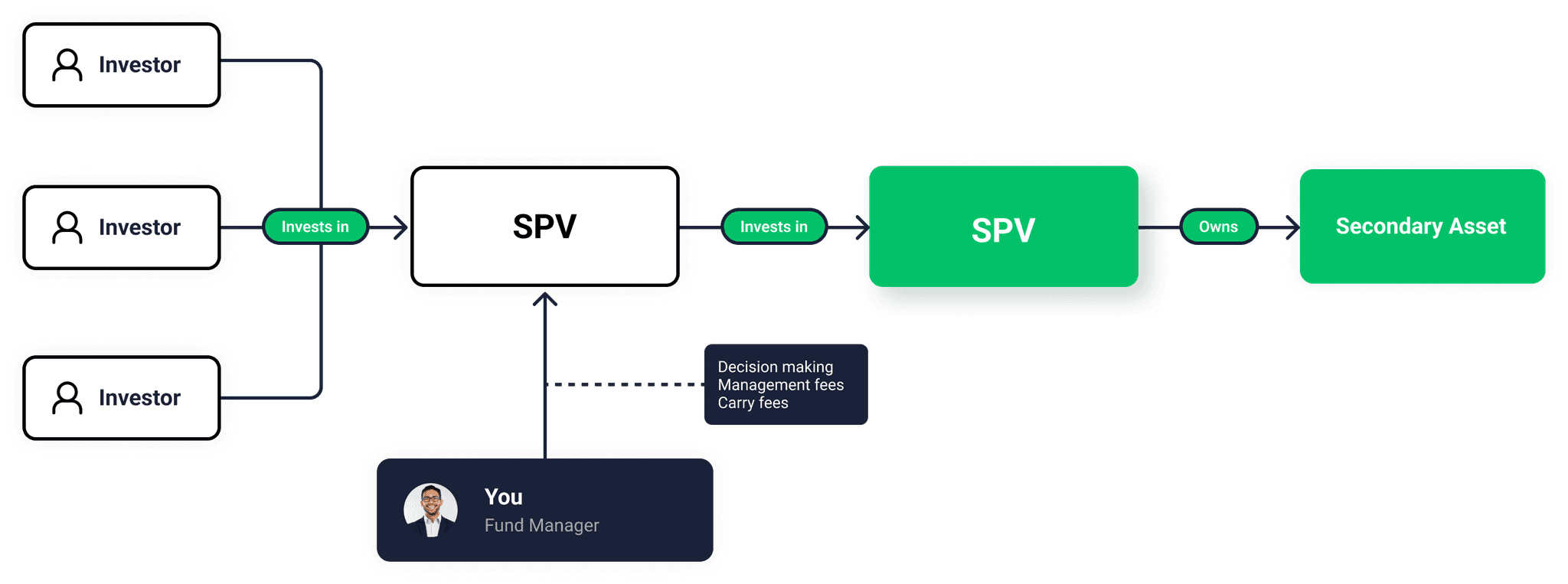

We support all deal structures

Whether you are buying directly from a founder or early investor, or structuring this deal by investing into another LLC, Allocations can support you to invest in any deal structure.

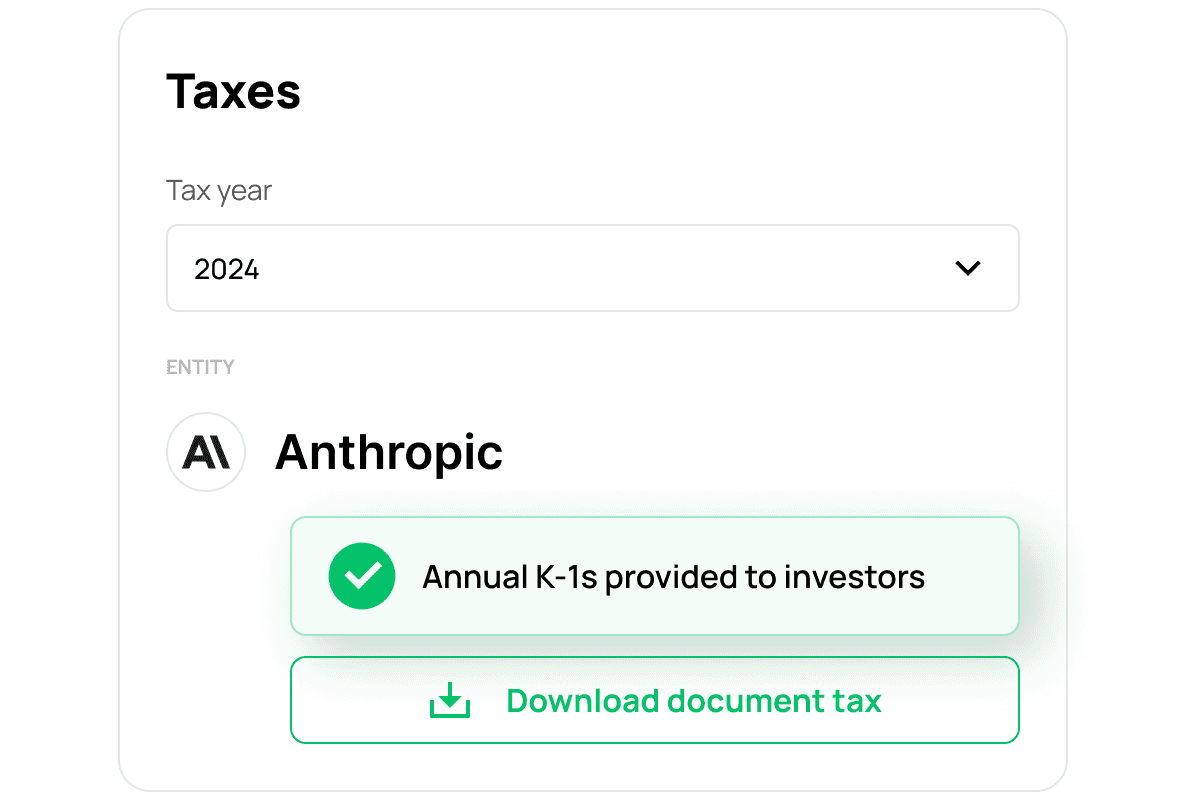

Tax support all the way

We will provide annual K1s to all of your investors, even if you are investing into another LLC

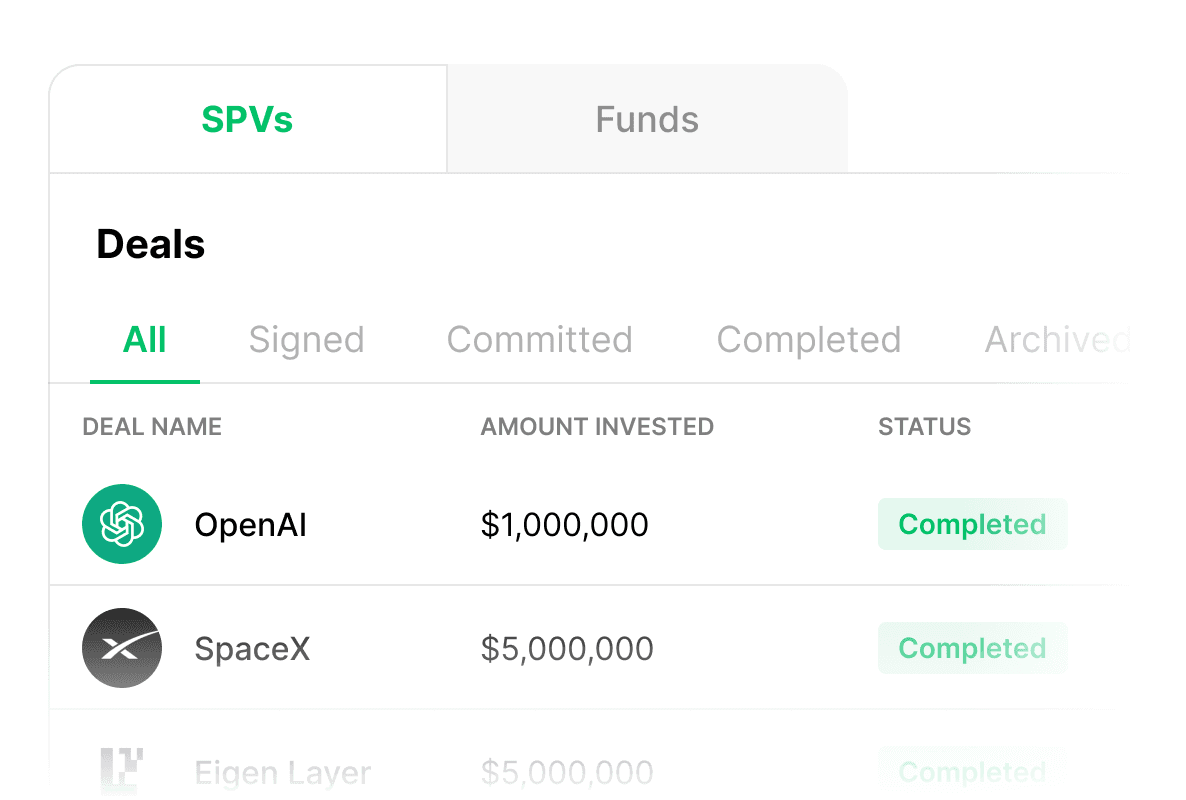

Full control of your SPVs

Keep full control of your deals by being the sole manager of the SPV. Allocations will simply act as the fund administrator of the SPV.

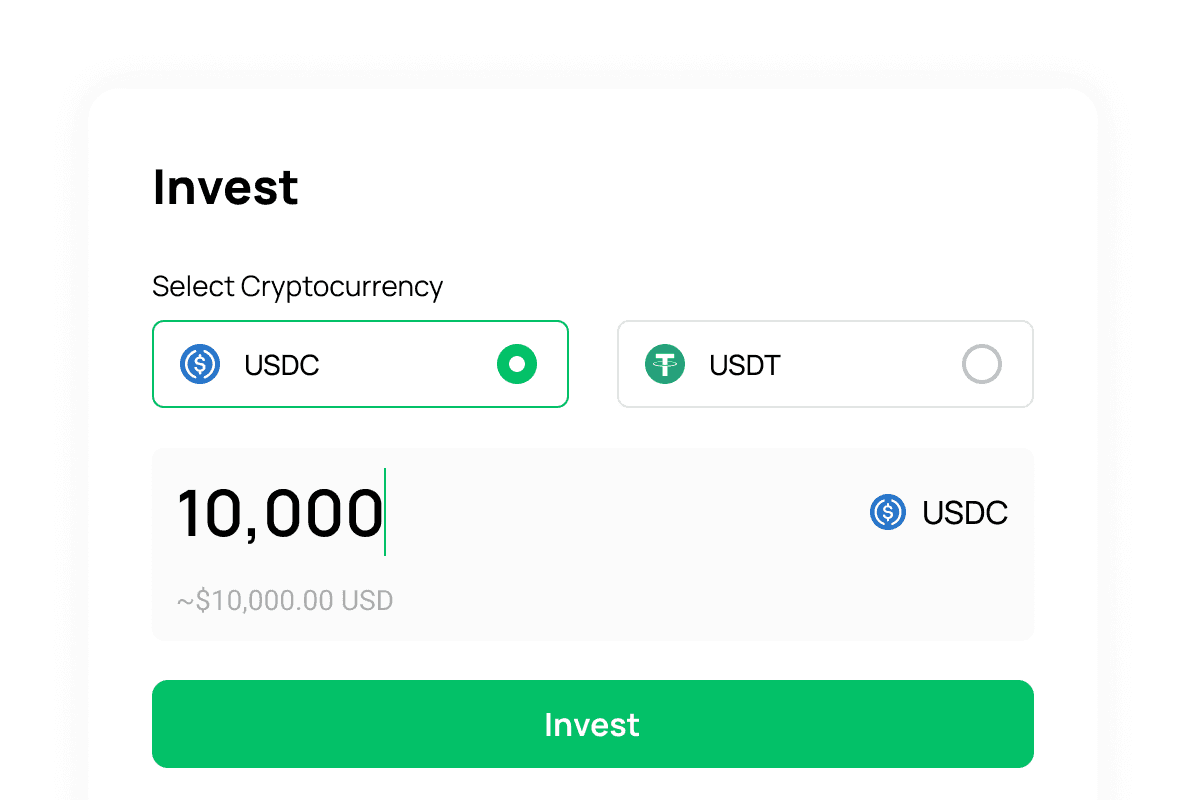

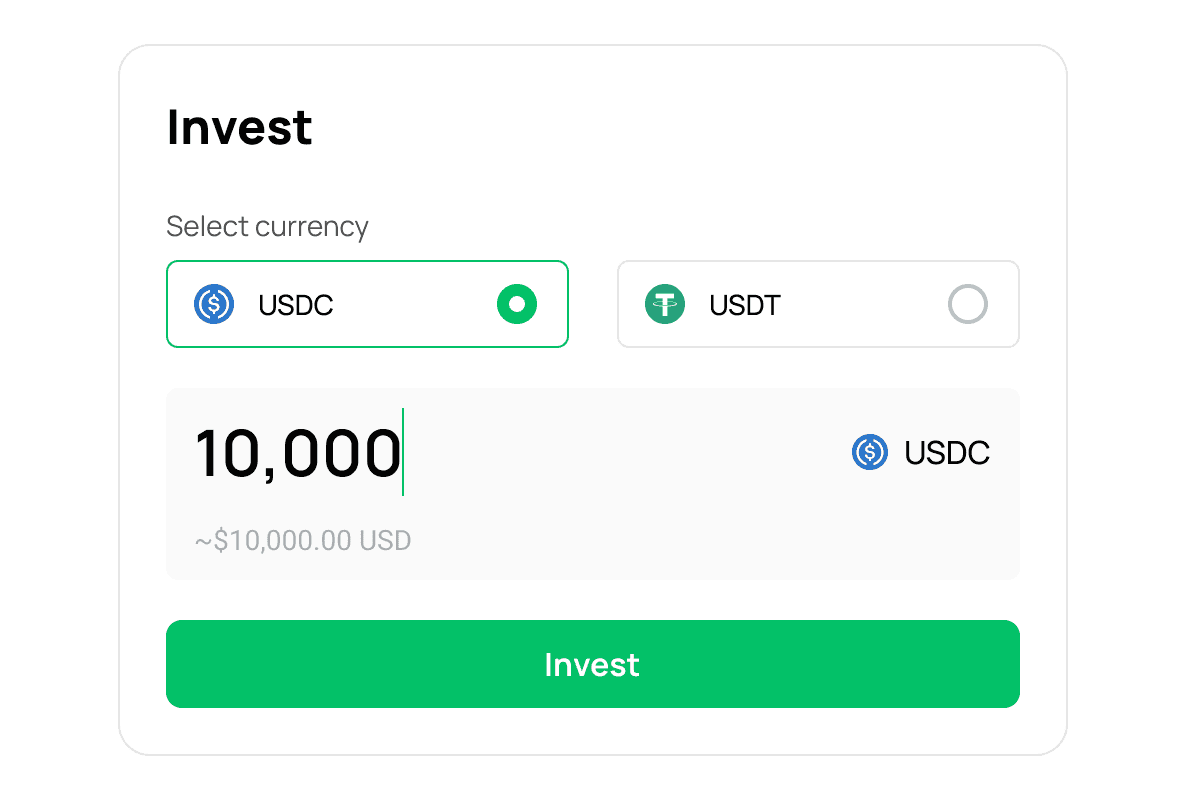

Accept crypto as capital contribution

Use our crypto payment solution to allow your LPs to invest in the SPV via cryptocurrency (USDC or USDT).

FEATURES

Setup

Entity formation

Bank account setup

EIN setup

Template SPV docs

Onboarding

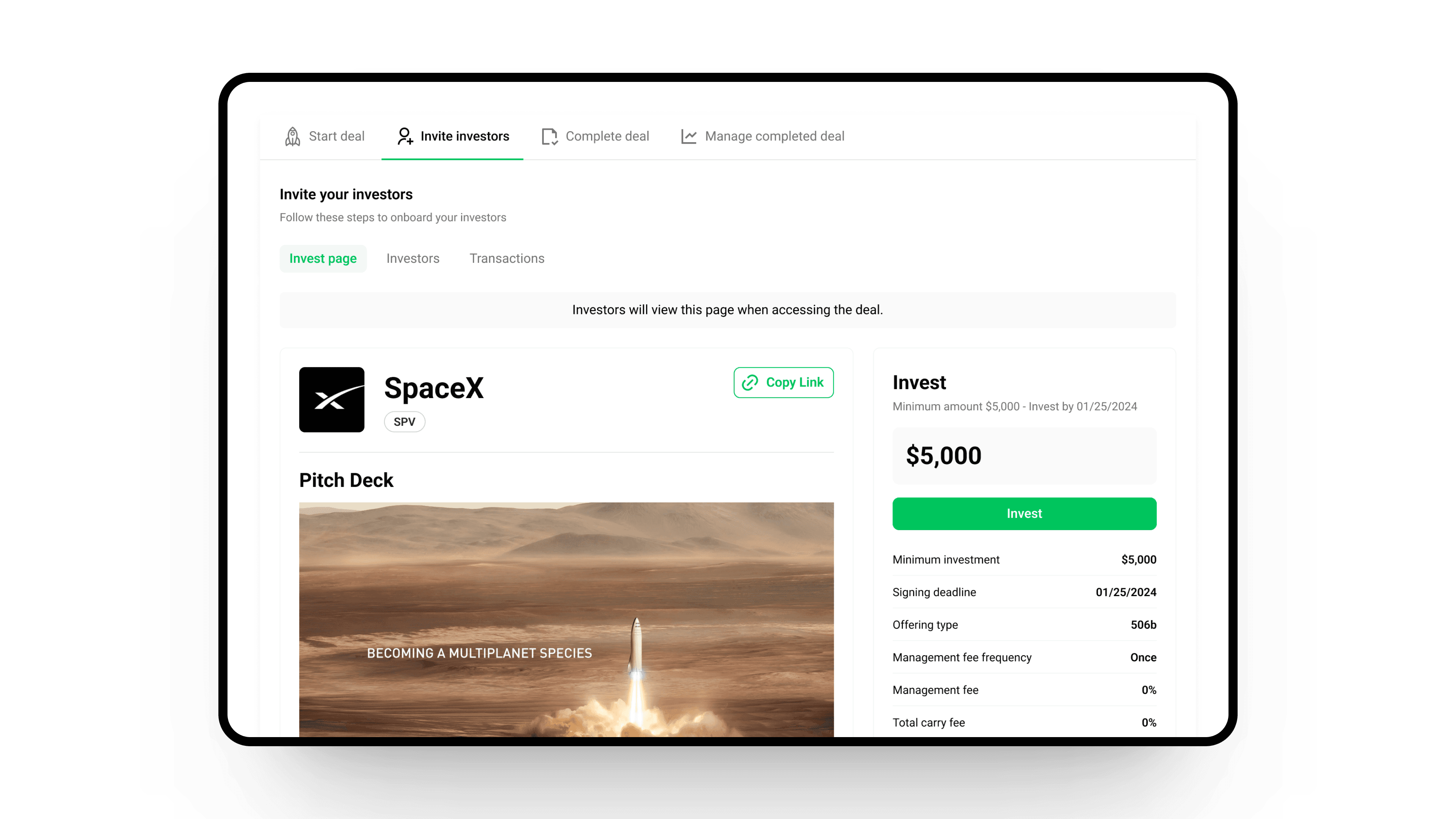

Invite investors

Instant invest

Deal page

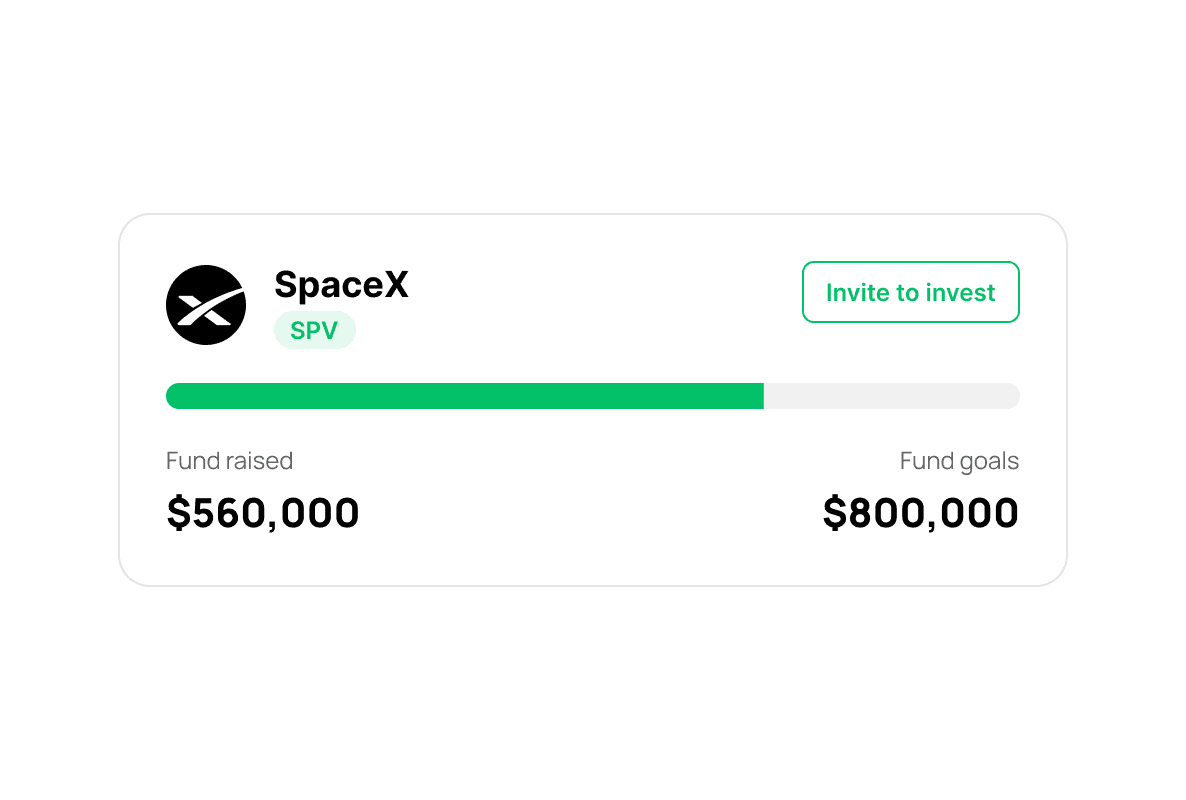

Deal tracker

Investor KYC

Post-close

Reg D filings

Capital account statements

K-1 filing

Accounting

BLOG

SPVs

How do you structure an SPV into another SPV?

This involves a legal structure where one SPV invests into another SPV. Reasons for this structure might include acquiring a secondary interest from an existing SPV.

SPVs

What are secondary SPVs?

Secondary SPVs are special purpose vehicles that invest in a secondary asset from an existing holder of a security. Sales of an asset not directly from company itself are known as secondary sales, or sales on the secondary market.

SPVs

6 unique use cases for SPVs

Private markets are quickly evolving, creating both challenges and opportunities for fund managers and their investors. At the same time, Special Purpose Vehicles (SPVs) are becoming an important tool for private market participants. Angel groups, solo GPs, emerging managers, family offices and investor communities are turning to SPVs to get deals done quickly and cost effectively.

Start building private equity products today with Allocations.