Back

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

At Allocations.com — a platform trusted by hundreds of users every day and managing over $2 billion in assets— we are redefining the future of fund administration. We know the importance of innovation and efficiency. Over the past year, we’ve embarked on a journey to transform our platform, pushing the boundaries of what’s possible.

From the release of Version 3 in 2023 to the groundbreaking launch of Version 4 in 2024, we’ve focused on one goal: delivering a seamless, powerful, and user-friendly experience for fund managers and investors alike.

The Road to Version 4: Identifying the Gaps

In April 2023, we introduced Version 3, a significant upgrade to our older, slower system. This version brought much-needed improvements, such as faster performance, enhanced functionality, and increased reliability.

It quickly became evident that these changes were making fund management easier and more effective for our users. However, as our platform grew, so did the demands of our community. We recognized the need to go beyond incremental updates and rethink the platform to eliminate inefficiencies, improve onboarding, and simplify complex workflows. Version 3 laid the foundation for change, but we knew we could do even better.

Version 4: A Game-Changer for Fund Management

In July 2024, we started to work on Version 4, a revolutionary step forward for Allocations.com. With a 50% reduction in code complexity, an 80% improvement in processing speed, and 100% time savings for users, V4 was designed with simplicity and performance in mind.The onboarding process is now streamlined, taking users from start to finish faster than ever before. Identity verification and investment tracking have been transformed into intuitive, user-friendly experiences.

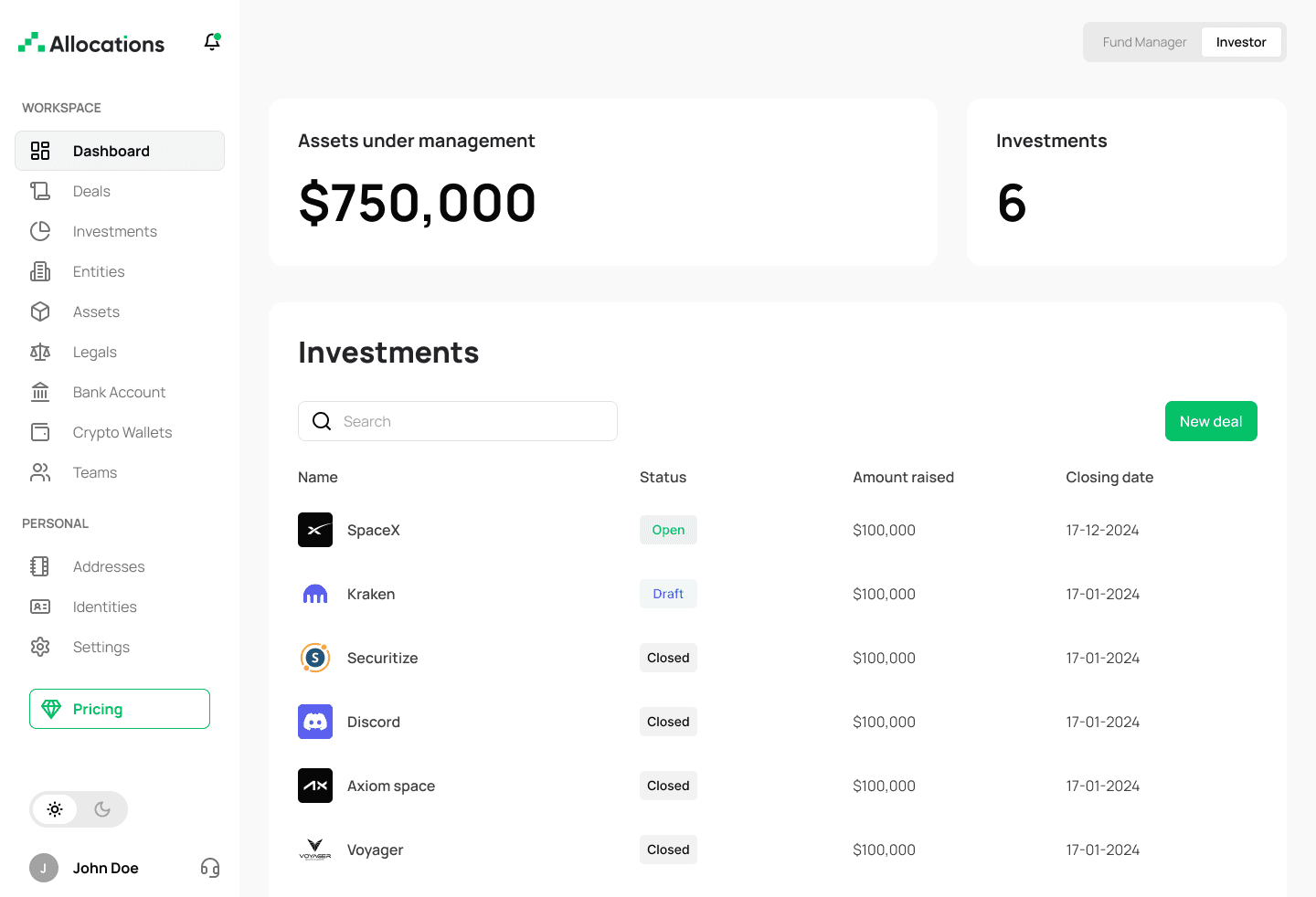

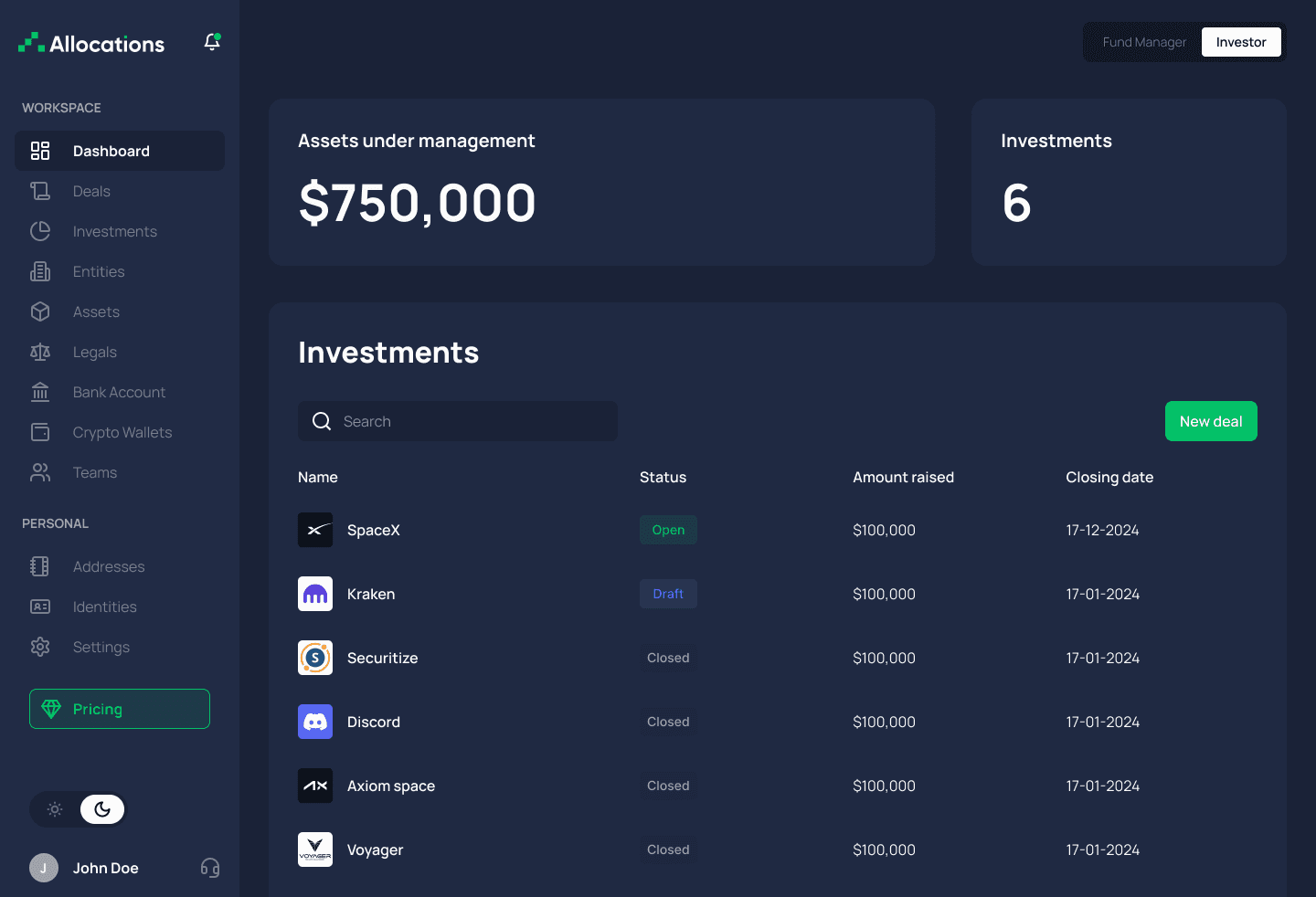

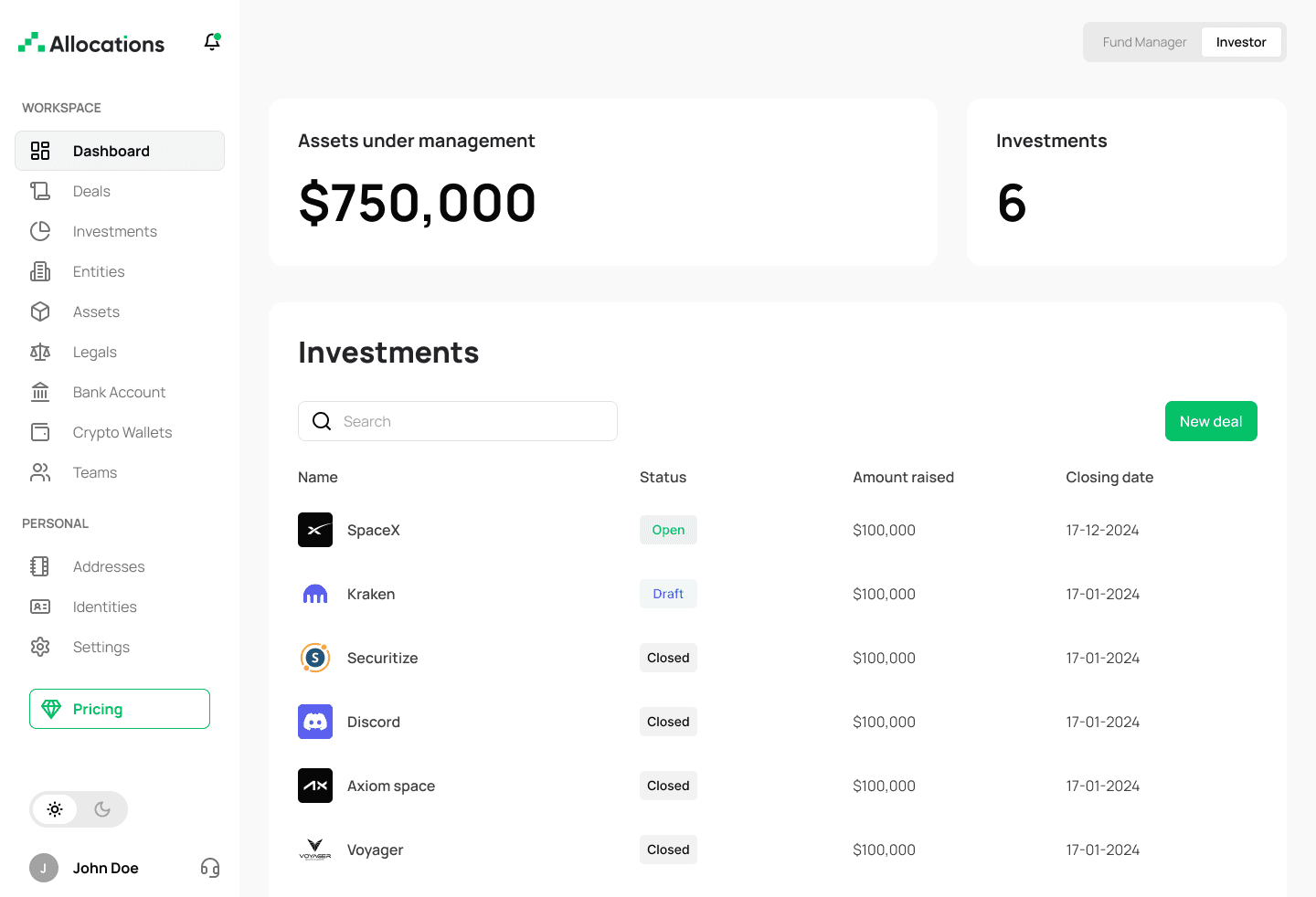

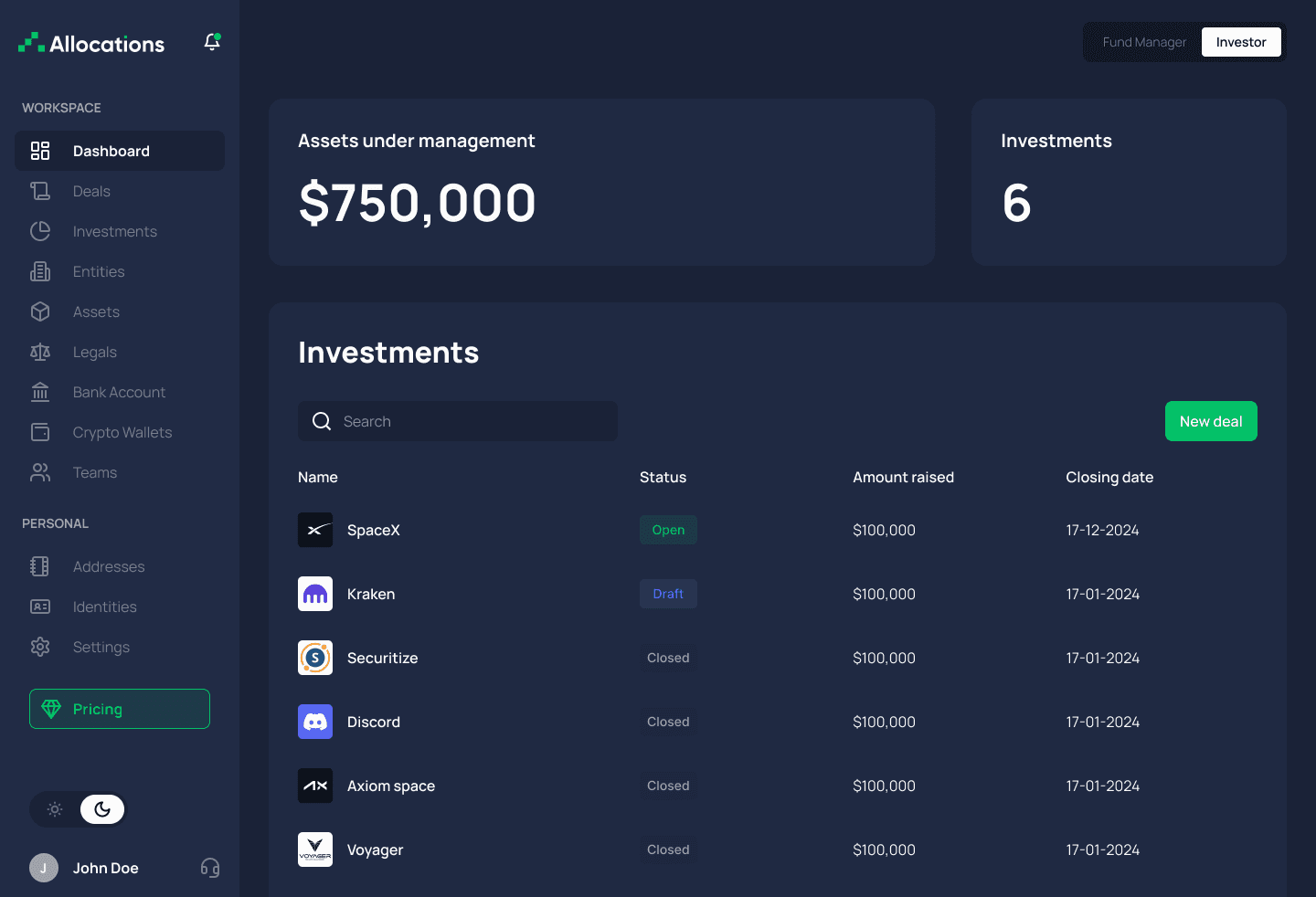

Beyond functionality, the design received a complete overhaul. Version 4 features a sleek, modern interface that is as pleasing to the eye as it is practical. This cleaner design doesn’t just look good — it enhances focus, minimizes distractions, and allows users to navigate their workflows effortlessly. With V4, fund managers and investors alike can save time, reduce friction, and focus on what matters most: making informed decisions and growing their assets.

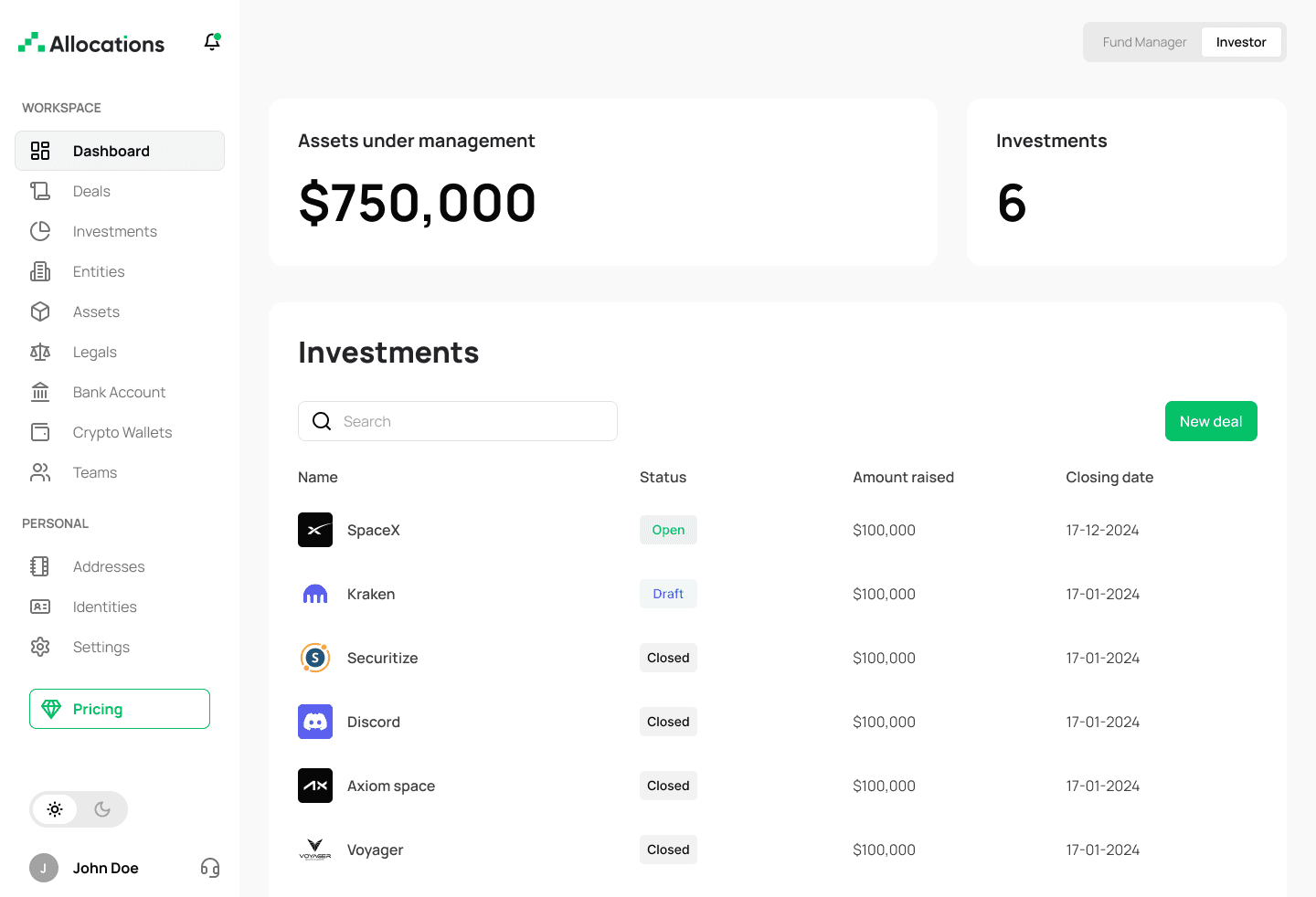

Light version

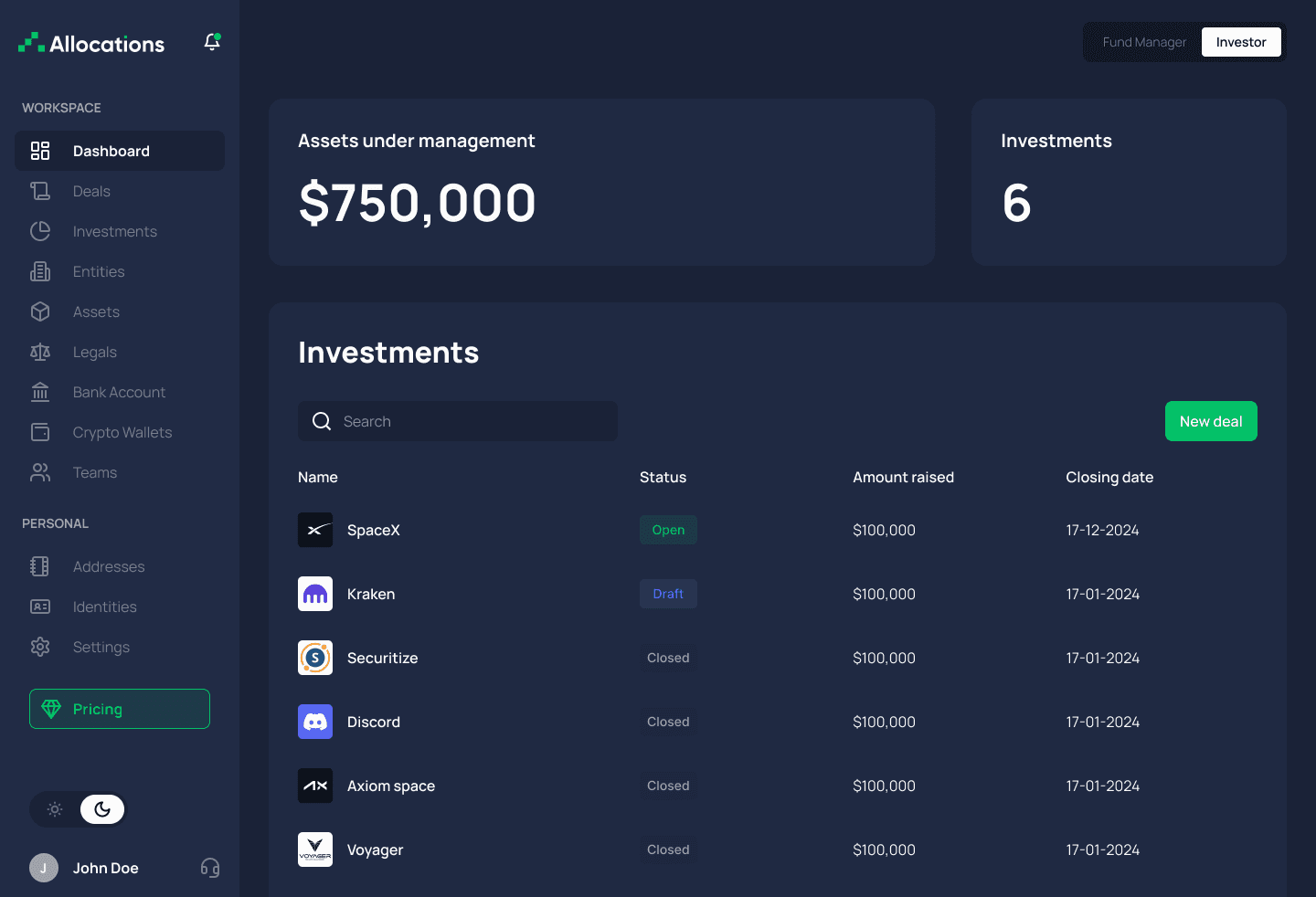

Dark version

What We’ve Learned and Where We’re Headed

The journey from V3 to V4 taught us invaluable lessons about simplicity, speed, and user-centric design. One of the most critical insights was that less truly is more. By stripping away unnecessary complexities, we were able to deliver a product that is both powerful and easy to use. We also embraced AI technologies to accelerate development and ensure that our platform continues to meet the evolving needs of our users.

Looking ahead to 2025, we are focused on building new features and products that align with our users’ real-world needs. Our mission is to reduce friction even further, listen to user feedback, and create solutions that truly make a difference. We’re not just building a platform — we’re setting a new standard in fund management.

At Allocations.com, innovation isn’t just a goal; it’s a mindset. With the launch of Version 4, we’ve taken a bold leap forward in fund administration, proving that simplicity and efficiency can go hand in hand. As we continue to grow and evolve, our focus remains on delivering the best experience for our users. The future is full of opportunities, and we’re ready to lead the way, empowering fund managers and investors to succeed like never before.

Guillaume Duhan

CTO @Allocations.com

At Allocations.com — a platform trusted by hundreds of users every day and managing over $2 billion in assets— we are redefining the future of fund administration. We know the importance of innovation and efficiency. Over the past year, we’ve embarked on a journey to transform our platform, pushing the boundaries of what’s possible.

From the release of Version 3 in 2023 to the groundbreaking launch of Version 4 in 2024, we’ve focused on one goal: delivering a seamless, powerful, and user-friendly experience for fund managers and investors alike.

The Road to Version 4: Identifying the Gaps

In April 2023, we introduced Version 3, a significant upgrade to our older, slower system. This version brought much-needed improvements, such as faster performance, enhanced functionality, and increased reliability.

It quickly became evident that these changes were making fund management easier and more effective for our users. However, as our platform grew, so did the demands of our community. We recognized the need to go beyond incremental updates and rethink the platform to eliminate inefficiencies, improve onboarding, and simplify complex workflows. Version 3 laid the foundation for change, but we knew we could do even better.

Version 4: A Game-Changer for Fund Management

In July 2024, we started to work on Version 4, a revolutionary step forward for Allocations.com. With a 50% reduction in code complexity, an 80% improvement in processing speed, and 100% time savings for users, V4 was designed with simplicity and performance in mind.The onboarding process is now streamlined, taking users from start to finish faster than ever before. Identity verification and investment tracking have been transformed into intuitive, user-friendly experiences.

Beyond functionality, the design received a complete overhaul. Version 4 features a sleek, modern interface that is as pleasing to the eye as it is practical. This cleaner design doesn’t just look good — it enhances focus, minimizes distractions, and allows users to navigate their workflows effortlessly. With V4, fund managers and investors alike can save time, reduce friction, and focus on what matters most: making informed decisions and growing their assets.

Light version

Dark version

What We’ve Learned and Where We’re Headed

The journey from V3 to V4 taught us invaluable lessons about simplicity, speed, and user-centric design. One of the most critical insights was that less truly is more. By stripping away unnecessary complexities, we were able to deliver a product that is both powerful and easy to use. We also embraced AI technologies to accelerate development and ensure that our platform continues to meet the evolving needs of our users.

Looking ahead to 2025, we are focused on building new features and products that align with our users’ real-world needs. Our mission is to reduce friction even further, listen to user feedback, and create solutions that truly make a difference. We’re not just building a platform — we’re setting a new standard in fund management.

At Allocations.com, innovation isn’t just a goal; it’s a mindset. With the launch of Version 4, we’ve taken a bold leap forward in fund administration, proving that simplicity and efficiency can go hand in hand. As we continue to grow and evolve, our focus remains on delivering the best experience for our users. The future is full of opportunities, and we’re ready to lead the way, empowering fund managers and investors to succeed like never before.

Guillaume Duhan

CTO @Allocations.com

At Allocations.com — a platform trusted by hundreds of users every day and managing over $2 billion in assets— we are redefining the future of fund administration. We know the importance of innovation and efficiency. Over the past year, we’ve embarked on a journey to transform our platform, pushing the boundaries of what’s possible.

From the release of Version 3 in 2023 to the groundbreaking launch of Version 4 in 2024, we’ve focused on one goal: delivering a seamless, powerful, and user-friendly experience for fund managers and investors alike.

The Road to Version 4: Identifying the Gaps

In April 2023, we introduced Version 3, a significant upgrade to our older, slower system. This version brought much-needed improvements, such as faster performance, enhanced functionality, and increased reliability.

It quickly became evident that these changes were making fund management easier and more effective for our users. However, as our platform grew, so did the demands of our community. We recognized the need to go beyond incremental updates and rethink the platform to eliminate inefficiencies, improve onboarding, and simplify complex workflows. Version 3 laid the foundation for change, but we knew we could do even better.

Version 4: A Game-Changer for Fund Management

In July 2024, we started to work on Version 4, a revolutionary step forward for Allocations.com. With a 50% reduction in code complexity, an 80% improvement in processing speed, and 100% time savings for users, V4 was designed with simplicity and performance in mind.The onboarding process is now streamlined, taking users from start to finish faster than ever before. Identity verification and investment tracking have been transformed into intuitive, user-friendly experiences.

Beyond functionality, the design received a complete overhaul. Version 4 features a sleek, modern interface that is as pleasing to the eye as it is practical. This cleaner design doesn’t just look good — it enhances focus, minimizes distractions, and allows users to navigate their workflows effortlessly. With V4, fund managers and investors alike can save time, reduce friction, and focus on what matters most: making informed decisions and growing their assets.

Light version

Dark version

What We’ve Learned and Where We’re Headed

The journey from V3 to V4 taught us invaluable lessons about simplicity, speed, and user-centric design. One of the most critical insights was that less truly is more. By stripping away unnecessary complexities, we were able to deliver a product that is both powerful and easy to use. We also embraced AI technologies to accelerate development and ensure that our platform continues to meet the evolving needs of our users.

Looking ahead to 2025, we are focused on building new features and products that align with our users’ real-world needs. Our mission is to reduce friction even further, listen to user feedback, and create solutions that truly make a difference. We’re not just building a platform — we’re setting a new standard in fund management.

At Allocations.com, innovation isn’t just a goal; it’s a mindset. With the launch of Version 4, we’ve taken a bold leap forward in fund administration, proving that simplicity and efficiency can go hand in hand. As we continue to grow and evolve, our focus remains on delivering the best experience for our users. The future is full of opportunities, and we’re ready to lead the way, empowering fund managers and investors to succeed like never before.

Guillaume Duhan

CTO @Allocations.com

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc