Back

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

The VC industry is exploding

For the first time in history, total US VC fundraising was more than $100 billion, shattering the previous record of $86 billion.

It may be late-stage institutional capital that drive that number up, but there’s plenty of early-stage activity too.

In the early-stages, it’s not VCs that drive the majority of growth — it’s emerging fund managers.

You can think of emerging fund managers in a few ways:

Founders that sold their companies and want to invest their winnings back into the startup ecosystem

High level executives that angel invest as a side-hustle

One-person media companies with a VC and startup leaning audience

But it’s not the case that emerging fund managers want to invest more than they used to. It’s just getting easier to manage the process.

Until recently, the VC industry was 90% people, fax machines, and paperwork. But in the past few years, that’s flipped. It’s now 90% software.

As more fund managers demand a better user experience and easier tools to manage their investments, the incentives to build these tools become difficult to ignore. After all, a growing market with high demand is attractive for any entrepreneur.

As a result, companies like Allocations are building these tools to support this growing market, upending the traditional, old school way of doing things.

The incentives to start VC investing are more attractive because the annoying back-office part of the process is automated with software.

More investors mean more deals.

More deals mean more winners.

And more winners means more capital back into the system.

Take a look at the charts and stats below, which illustrate just how impactful these trends are.

2021: Early-stage VC’s biggest year ever

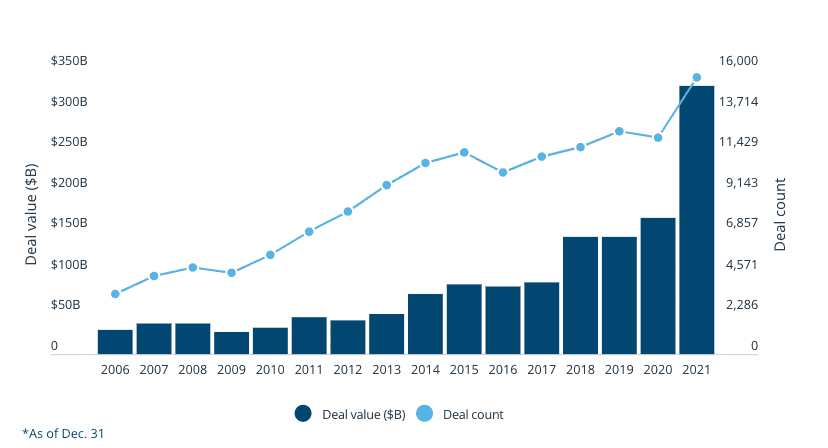

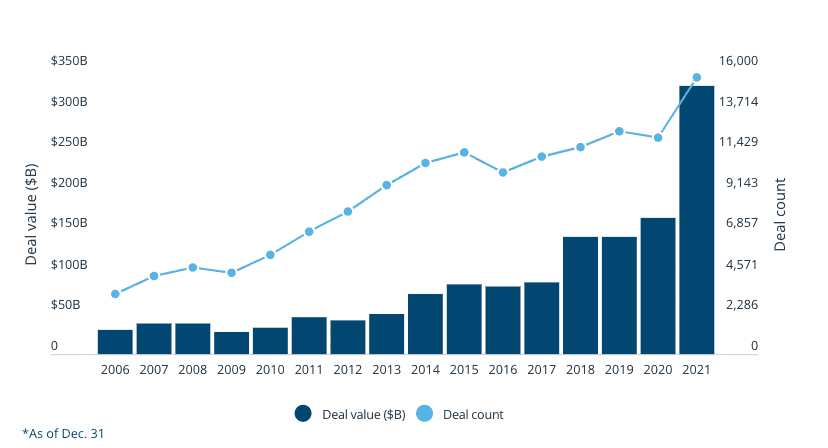

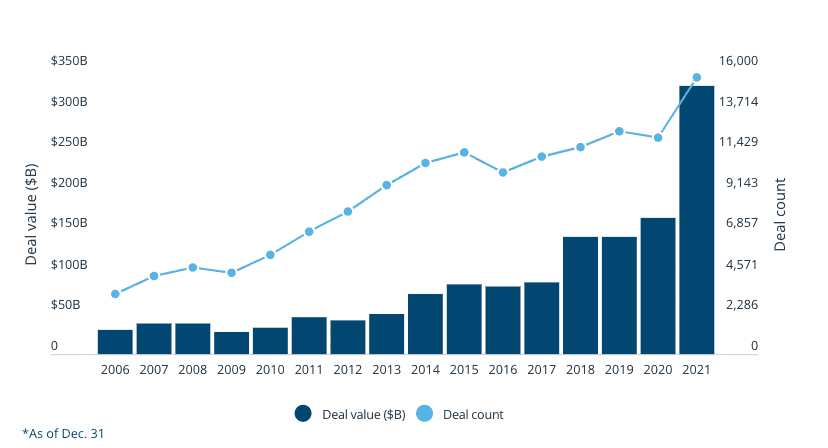

#1 VC investment doubled in 12 months. From 2020 to 2021, US startups raised close to double what they raised the previous year. Here are the numbers for context:

2020 - $166 billion

2021 - $329 billion

US VC investment nearly doubles from 2020 to 2021. Image courtesy of Pitchbook.

More capital in the markets is a good signal of long-term growth. This type of growth attracts new investors, as we’ll see in the next chart.

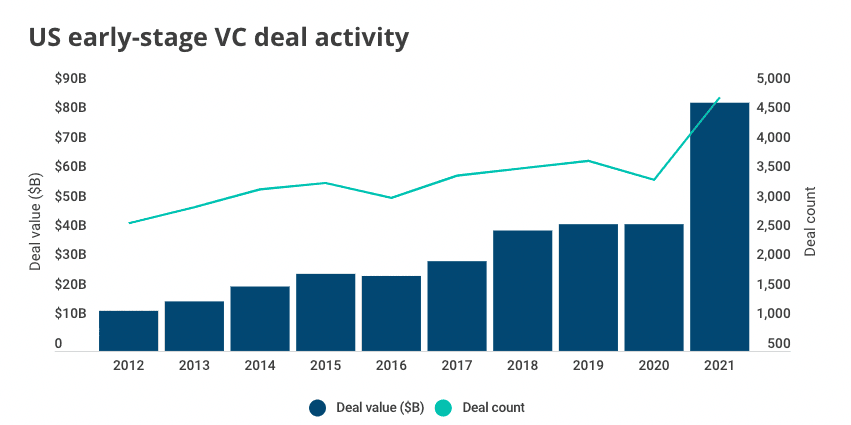

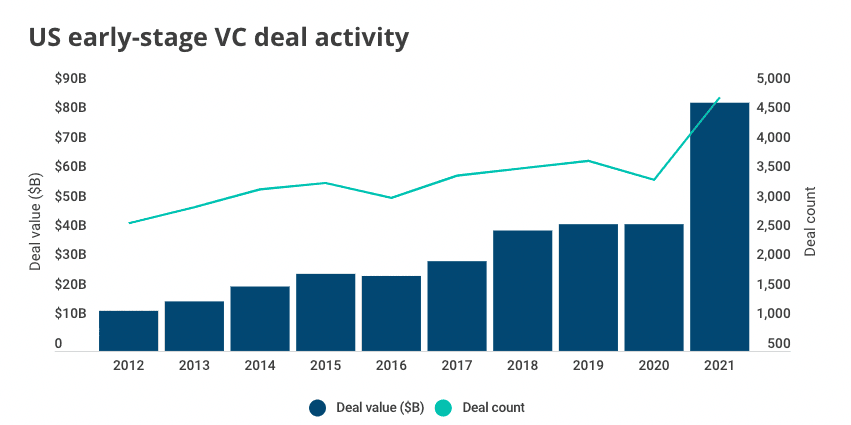

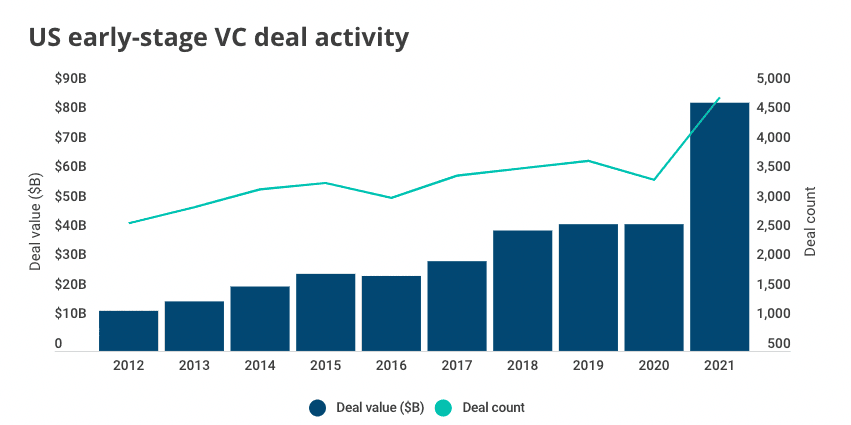

#2 Early-stage VC activity boomed. This chart shows a near-exponential growth of early-stage VC deal activity.

One hypothesis: more emerging fund managers entered the market, driving early-stage investment.

VC deal value jumps from $40B to $80B from 2020 to 2021. Image courtesy of Pitchbook.

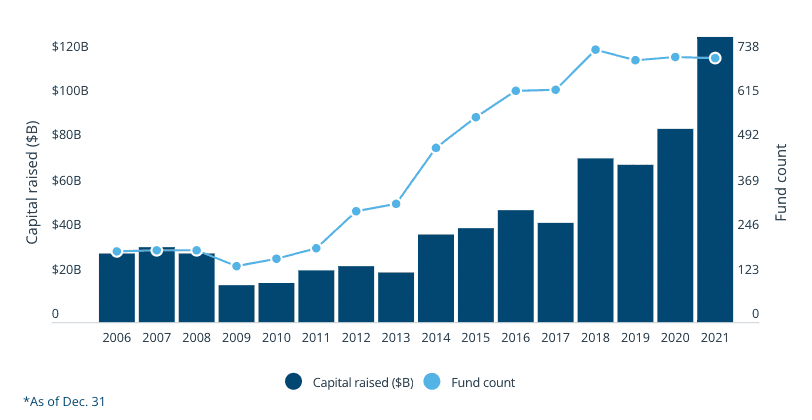

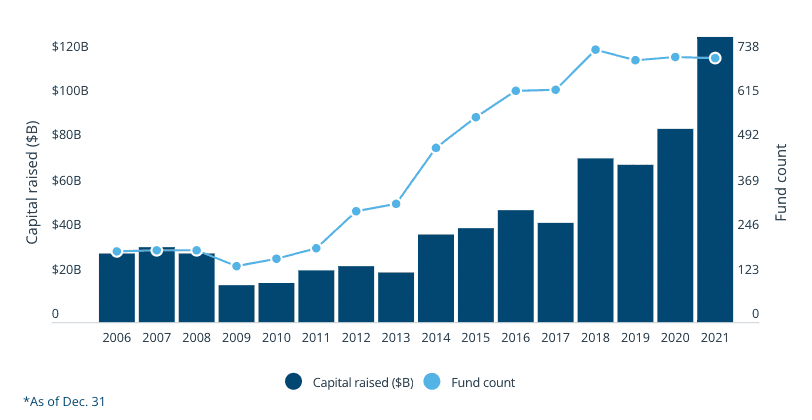

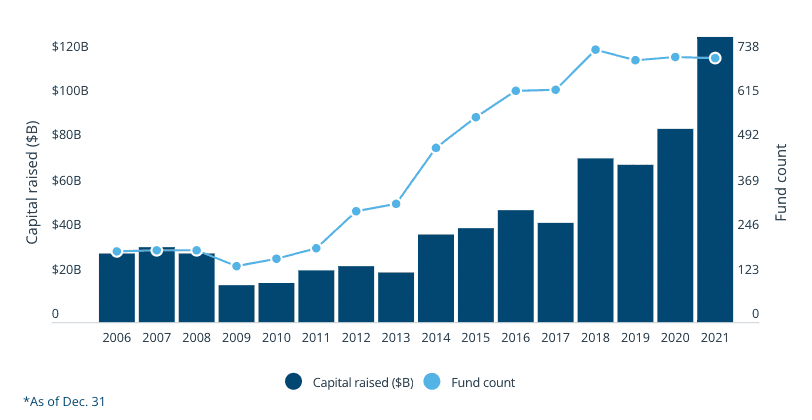

#3 Total VC Fundraising eclipsed $100 billion. All US VC firms raised over $100 billion for the first time. $128 billion to be exact. That shatters the previous record of $86 billion.

"US VC firms raised a record-shattering $128.3 billion in 2021." Image courtesy of Pitchbook.

If you ask an emerging fund manager what’s fueling this growth, they’ll give you several reasons. One that you’ll hear often: the industry is finally innovating.

Emerging fund managers are powered by tech

Software is eating the VC industry.

Even just a few years ago, the VC industry relied on outdated tech, annoying processes, and expensive accountants and lawyers.

Starting a fund and raising money was a long, grueling process.

But this is all changing.

It’s easier for emerging fund managers to run their funds and scale their businesses without the extra cost of a legal team, accountant, banker, and support staff. Raising and deploying capital is now easier and takes less time.

This leaves emerging fund managers with more time to spend on the important things:

building a network

due diligence

helping founders

Record growth in emerging managers

Emerging fund managers are the lifeblood of a thriving startup ecosystem.

They drive a majority of the early-stage growth we see in startup markets. They democratize capitalism by investing in founders that might not attract attention from the old school, traditional VC firms.

This is why we’ve built Allocations for the emerging fund manager. They work with founders at the most critical stage for a startup: the beginning.

Managing investments and LPs should be easy. Setting up legal docs and tax forms should be hassle-free. Building an SPV should take minutes, not months.

So if you’re ready to simplify your back office — and spend more time on due diligence and getting into deals – book a demo today.

The VC industry is exploding

For the first time in history, total US VC fundraising was more than $100 billion, shattering the previous record of $86 billion.

It may be late-stage institutional capital that drive that number up, but there’s plenty of early-stage activity too.

In the early-stages, it’s not VCs that drive the majority of growth — it’s emerging fund managers.

You can think of emerging fund managers in a few ways:

Founders that sold their companies and want to invest their winnings back into the startup ecosystem

High level executives that angel invest as a side-hustle

One-person media companies with a VC and startup leaning audience

But it’s not the case that emerging fund managers want to invest more than they used to. It’s just getting easier to manage the process.

Until recently, the VC industry was 90% people, fax machines, and paperwork. But in the past few years, that’s flipped. It’s now 90% software.

As more fund managers demand a better user experience and easier tools to manage their investments, the incentives to build these tools become difficult to ignore. After all, a growing market with high demand is attractive for any entrepreneur.

As a result, companies like Allocations are building these tools to support this growing market, upending the traditional, old school way of doing things.

The incentives to start VC investing are more attractive because the annoying back-office part of the process is automated with software.

More investors mean more deals.

More deals mean more winners.

And more winners means more capital back into the system.

Take a look at the charts and stats below, which illustrate just how impactful these trends are.

2021: Early-stage VC’s biggest year ever

#1 VC investment doubled in 12 months. From 2020 to 2021, US startups raised close to double what they raised the previous year. Here are the numbers for context:

2020 - $166 billion

2021 - $329 billion

US VC investment nearly doubles from 2020 to 2021. Image courtesy of Pitchbook.

More capital in the markets is a good signal of long-term growth. This type of growth attracts new investors, as we’ll see in the next chart.

#2 Early-stage VC activity boomed. This chart shows a near-exponential growth of early-stage VC deal activity.

One hypothesis: more emerging fund managers entered the market, driving early-stage investment.

VC deal value jumps from $40B to $80B from 2020 to 2021. Image courtesy of Pitchbook.

#3 Total VC Fundraising eclipsed $100 billion. All US VC firms raised over $100 billion for the first time. $128 billion to be exact. That shatters the previous record of $86 billion.

"US VC firms raised a record-shattering $128.3 billion in 2021." Image courtesy of Pitchbook.

If you ask an emerging fund manager what’s fueling this growth, they’ll give you several reasons. One that you’ll hear often: the industry is finally innovating.

Emerging fund managers are powered by tech

Software is eating the VC industry.

Even just a few years ago, the VC industry relied on outdated tech, annoying processes, and expensive accountants and lawyers.

Starting a fund and raising money was a long, grueling process.

But this is all changing.

It’s easier for emerging fund managers to run their funds and scale their businesses without the extra cost of a legal team, accountant, banker, and support staff. Raising and deploying capital is now easier and takes less time.

This leaves emerging fund managers with more time to spend on the important things:

building a network

due diligence

helping founders

Record growth in emerging managers

Emerging fund managers are the lifeblood of a thriving startup ecosystem.

They drive a majority of the early-stage growth we see in startup markets. They democratize capitalism by investing in founders that might not attract attention from the old school, traditional VC firms.

This is why we’ve built Allocations for the emerging fund manager. They work with founders at the most critical stage for a startup: the beginning.

Managing investments and LPs should be easy. Setting up legal docs and tax forms should be hassle-free. Building an SPV should take minutes, not months.

So if you’re ready to simplify your back office — and spend more time on due diligence and getting into deals – book a demo today.

The VC industry is exploding

For the first time in history, total US VC fundraising was more than $100 billion, shattering the previous record of $86 billion.

It may be late-stage institutional capital that drive that number up, but there’s plenty of early-stage activity too.

In the early-stages, it’s not VCs that drive the majority of growth — it’s emerging fund managers.

You can think of emerging fund managers in a few ways:

Founders that sold their companies and want to invest their winnings back into the startup ecosystem

High level executives that angel invest as a side-hustle

One-person media companies with a VC and startup leaning audience

But it’s not the case that emerging fund managers want to invest more than they used to. It’s just getting easier to manage the process.

Until recently, the VC industry was 90% people, fax machines, and paperwork. But in the past few years, that’s flipped. It’s now 90% software.

As more fund managers demand a better user experience and easier tools to manage their investments, the incentives to build these tools become difficult to ignore. After all, a growing market with high demand is attractive for any entrepreneur.

As a result, companies like Allocations are building these tools to support this growing market, upending the traditional, old school way of doing things.

The incentives to start VC investing are more attractive because the annoying back-office part of the process is automated with software.

More investors mean more deals.

More deals mean more winners.

And more winners means more capital back into the system.

Take a look at the charts and stats below, which illustrate just how impactful these trends are.

2021: Early-stage VC’s biggest year ever

#1 VC investment doubled in 12 months. From 2020 to 2021, US startups raised close to double what they raised the previous year. Here are the numbers for context:

2020 - $166 billion

2021 - $329 billion

US VC investment nearly doubles from 2020 to 2021. Image courtesy of Pitchbook.

More capital in the markets is a good signal of long-term growth. This type of growth attracts new investors, as we’ll see in the next chart.

#2 Early-stage VC activity boomed. This chart shows a near-exponential growth of early-stage VC deal activity.

One hypothesis: more emerging fund managers entered the market, driving early-stage investment.

VC deal value jumps from $40B to $80B from 2020 to 2021. Image courtesy of Pitchbook.

#3 Total VC Fundraising eclipsed $100 billion. All US VC firms raised over $100 billion for the first time. $128 billion to be exact. That shatters the previous record of $86 billion.

"US VC firms raised a record-shattering $128.3 billion in 2021." Image courtesy of Pitchbook.

If you ask an emerging fund manager what’s fueling this growth, they’ll give you several reasons. One that you’ll hear often: the industry is finally innovating.

Emerging fund managers are powered by tech

Software is eating the VC industry.

Even just a few years ago, the VC industry relied on outdated tech, annoying processes, and expensive accountants and lawyers.

Starting a fund and raising money was a long, grueling process.

But this is all changing.

It’s easier for emerging fund managers to run their funds and scale their businesses without the extra cost of a legal team, accountant, banker, and support staff. Raising and deploying capital is now easier and takes less time.

This leaves emerging fund managers with more time to spend on the important things:

building a network

due diligence

helping founders

Record growth in emerging managers

Emerging fund managers are the lifeblood of a thriving startup ecosystem.

They drive a majority of the early-stage growth we see in startup markets. They democratize capitalism by investing in founders that might not attract attention from the old school, traditional VC firms.

This is why we’ve built Allocations for the emerging fund manager. They work with founders at the most critical stage for a startup: the beginning.

Managing investments and LPs should be easy. Setting up legal docs and tax forms should be hassle-free. Building an SPV should take minutes, not months.

So if you’re ready to simplify your back office — and spend more time on due diligence and getting into deals – book a demo today.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

Read more

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

Read more

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Read more

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Read more

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Read more

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Read more

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Read more

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Read more

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Read more

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Read more

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Read more

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Read more

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

Read more

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Read more

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Read more

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Read more

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Read more

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Read more

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Read more

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Read more

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Read more

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Read more

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Read more

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Read more

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Read more

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Read more

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Read more

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Read more

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Read more

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Read more

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc