Back

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

A brief summary of structuring one SPV into another SPV.

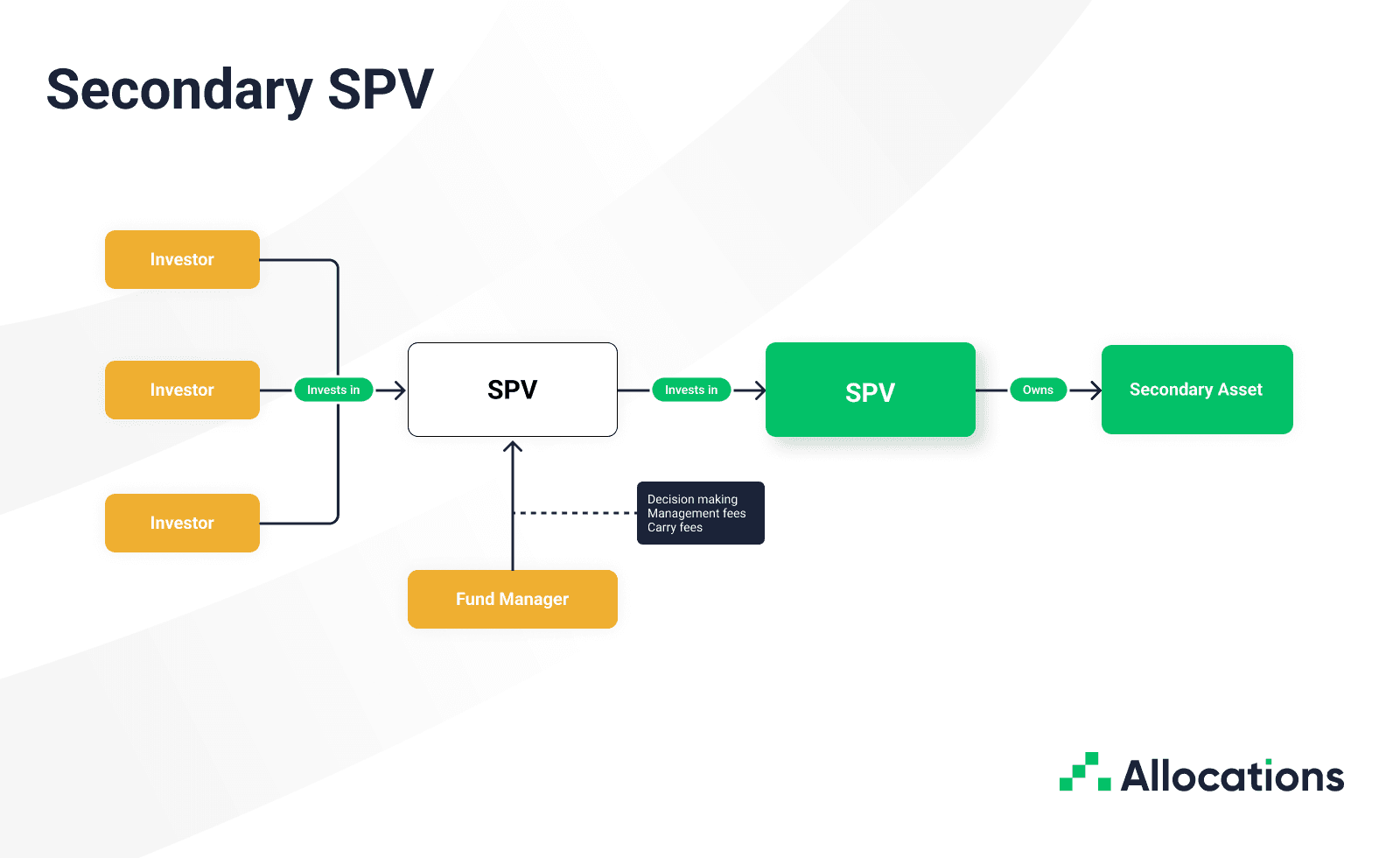

This involves a legal structure where one SPV invests into another SPV. Reasons for this structure might include acquiring a secondary interest from an existing SPV.

Benefits:

Access: Gain access to more types of deals through existing SPVs.

Membership Interest: Leverage membership interest benefits of SPVs to streamline the acquisition of shares.

Legal Structure: Clear legal structure with existing ownership of an asset.

Structure Considerations:

Investment Agreement: It’s important to ensure the investment agreement into the second SPV is clear and accurately represents the securities being purchased.

Tax Returns: It’s crucial to consider the tax return implications of having two SPVs. Usually, there will be pass-through SPV returns from SPV 2 to SPV 1. The fund administrator may need to wait to receive tax returns from SPV 2.

Fees: There are twice as many sources of fees to consider across SPVs, management, and carry fees. The fund administrator needs to be able to calculate the fee breakdown.

Fund Admin Support: As of April 2024, AngelList has reportedly discontinued support for the SPV into SPV structure. Common complexities that may have contributed to this include: Tax Returns: SPV into SPV typically causes delayed K-1s due to waiting for the second SPV’s tax returns and additional fees that can complicate the calculations. Fees: With two SPVs, there are typically fees from both, including administration fees, management fees, and carry fees.

Conclusion

SPV into SPV can be more complex than standard SPVs, so it is important to partner with a strong fund administrator that can support these transactions. Allocations.com has powered many SPV into SPV transactions, e.g., multiple SpaceX SPV into SPV transactions. The platform was built to support these types of deals and will continue to do so 🚀.

A brief summary of structuring one SPV into another SPV.

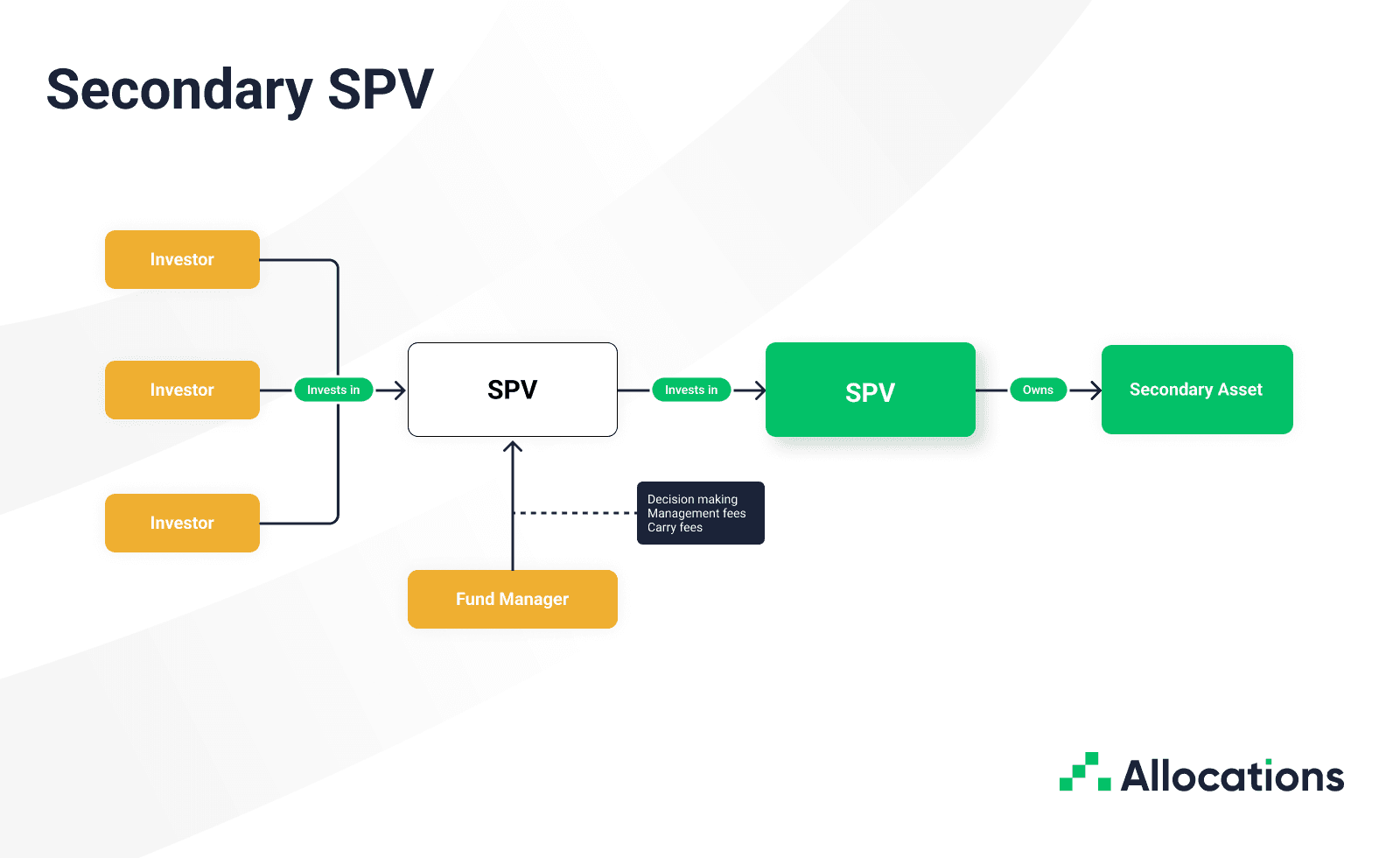

This involves a legal structure where one SPV invests into another SPV. Reasons for this structure might include acquiring a secondary interest from an existing SPV.

Benefits:

Access: Gain access to more types of deals through existing SPVs.

Membership Interest: Leverage membership interest benefits of SPVs to streamline the acquisition of shares.

Legal Structure: Clear legal structure with existing ownership of an asset.

Structure Considerations:

Investment Agreement: It’s important to ensure the investment agreement into the second SPV is clear and accurately represents the securities being purchased.

Tax Returns: It’s crucial to consider the tax return implications of having two SPVs. Usually, there will be pass-through SPV returns from SPV 2 to SPV 1. The fund administrator may need to wait to receive tax returns from SPV 2.

Fees: There are twice as many sources of fees to consider across SPVs, management, and carry fees. The fund administrator needs to be able to calculate the fee breakdown.

Fund Admin Support: As of April 2024, AngelList has reportedly discontinued support for the SPV into SPV structure. Common complexities that may have contributed to this include: Tax Returns: SPV into SPV typically causes delayed K-1s due to waiting for the second SPV’s tax returns and additional fees that can complicate the calculations. Fees: With two SPVs, there are typically fees from both, including administration fees, management fees, and carry fees.

Conclusion

SPV into SPV can be more complex than standard SPVs, so it is important to partner with a strong fund administrator that can support these transactions. Allocations.com has powered many SPV into SPV transactions, e.g., multiple SpaceX SPV into SPV transactions. The platform was built to support these types of deals and will continue to do so 🚀.

A brief summary of structuring one SPV into another SPV.

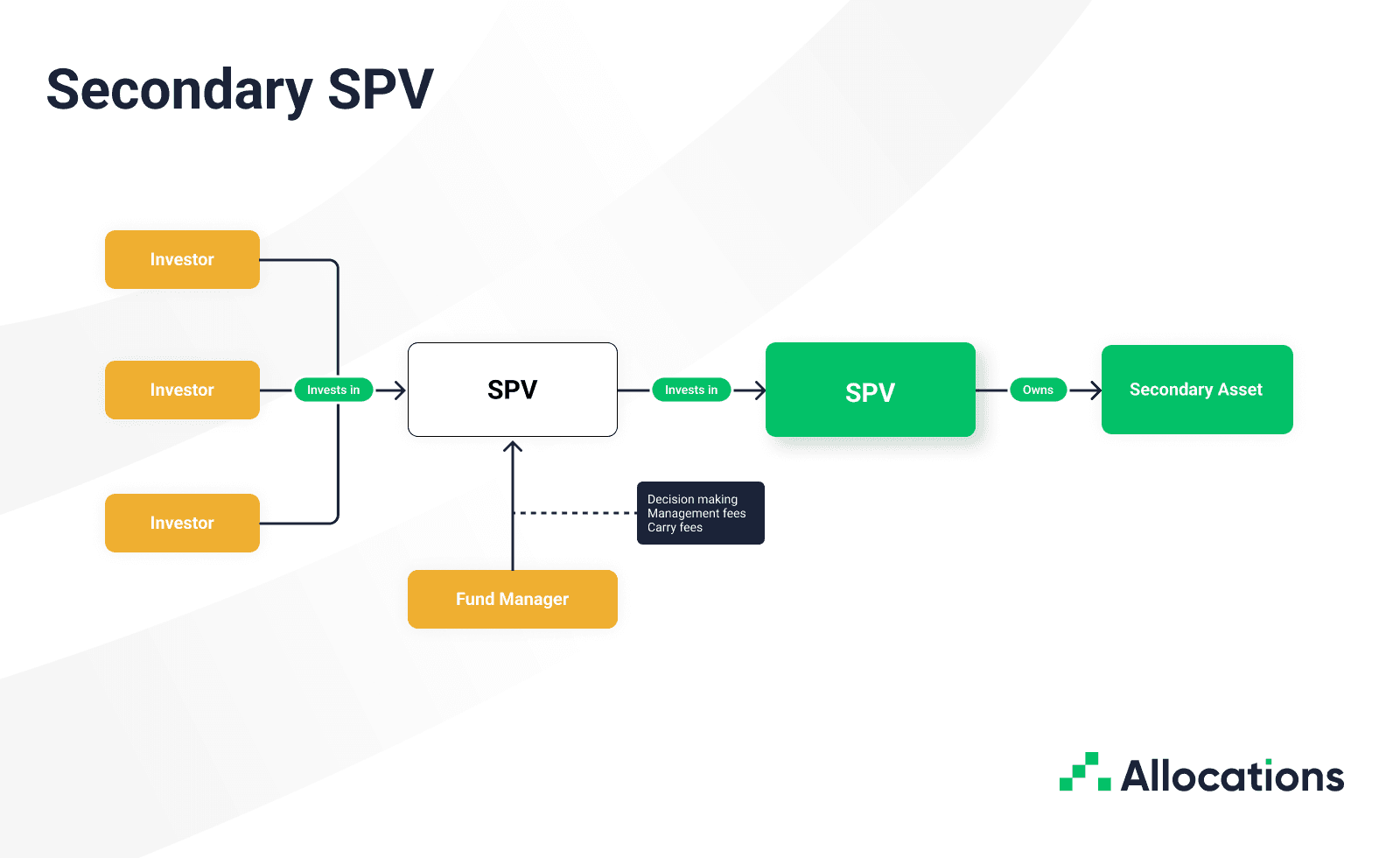

This involves a legal structure where one SPV invests into another SPV. Reasons for this structure might include acquiring a secondary interest from an existing SPV.

Benefits:

Access: Gain access to more types of deals through existing SPVs.

Membership Interest: Leverage membership interest benefits of SPVs to streamline the acquisition of shares.

Legal Structure: Clear legal structure with existing ownership of an asset.

Structure Considerations:

Investment Agreement: It’s important to ensure the investment agreement into the second SPV is clear and accurately represents the securities being purchased.

Tax Returns: It’s crucial to consider the tax return implications of having two SPVs. Usually, there will be pass-through SPV returns from SPV 2 to SPV 1. The fund administrator may need to wait to receive tax returns from SPV 2.

Fees: There are twice as many sources of fees to consider across SPVs, management, and carry fees. The fund administrator needs to be able to calculate the fee breakdown.

Fund Admin Support: As of April 2024, AngelList has reportedly discontinued support for the SPV into SPV structure. Common complexities that may have contributed to this include: Tax Returns: SPV into SPV typically causes delayed K-1s due to waiting for the second SPV’s tax returns and additional fees that can complicate the calculations. Fees: With two SPVs, there are typically fees from both, including administration fees, management fees, and carry fees.

Conclusion

SPV into SPV can be more complex than standard SPVs, so it is important to partner with a strong fund administrator that can support these transactions. Allocations.com has powered many SPV into SPV transactions, e.g., multiple SpaceX SPV into SPV transactions. The platform was built to support these types of deals and will continue to do so 🚀.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

Read more

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

Read more

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Read more

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Read more

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Read more

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Read more

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Read more

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Read more

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Read more

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Read more

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Read more

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Read more

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

Read more

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Read more

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Read more

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Read more

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Read more

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Read more

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Read more

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Read more

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Read more

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Read more

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Read more

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Read more

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Read more

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Read more

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Read more

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Read more

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Read more

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Read more

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc