Private markets are quickly evolving, creating both challenges and opportunities for fund managers and their investors. At the same time, Special Purpose Vehicles (SPVs) are becoming an important tool for private market participants.

Angel groups, solo GPs, emerging managers, family offices and investor communities are turning to SPVs to get deals done quickly and cost effectively.

Even institutional sized investors and large VCs are paying attention to SPVs- we predict that eventually these institutions will offer their clients access to SPVs in order to stay competitive.

Although SPVs have been around for a long time, they’ve become more cost effective over the past few years due to digital platforms such as Allocations. The use of SPVs opens up opportunities for investors of all sizes.

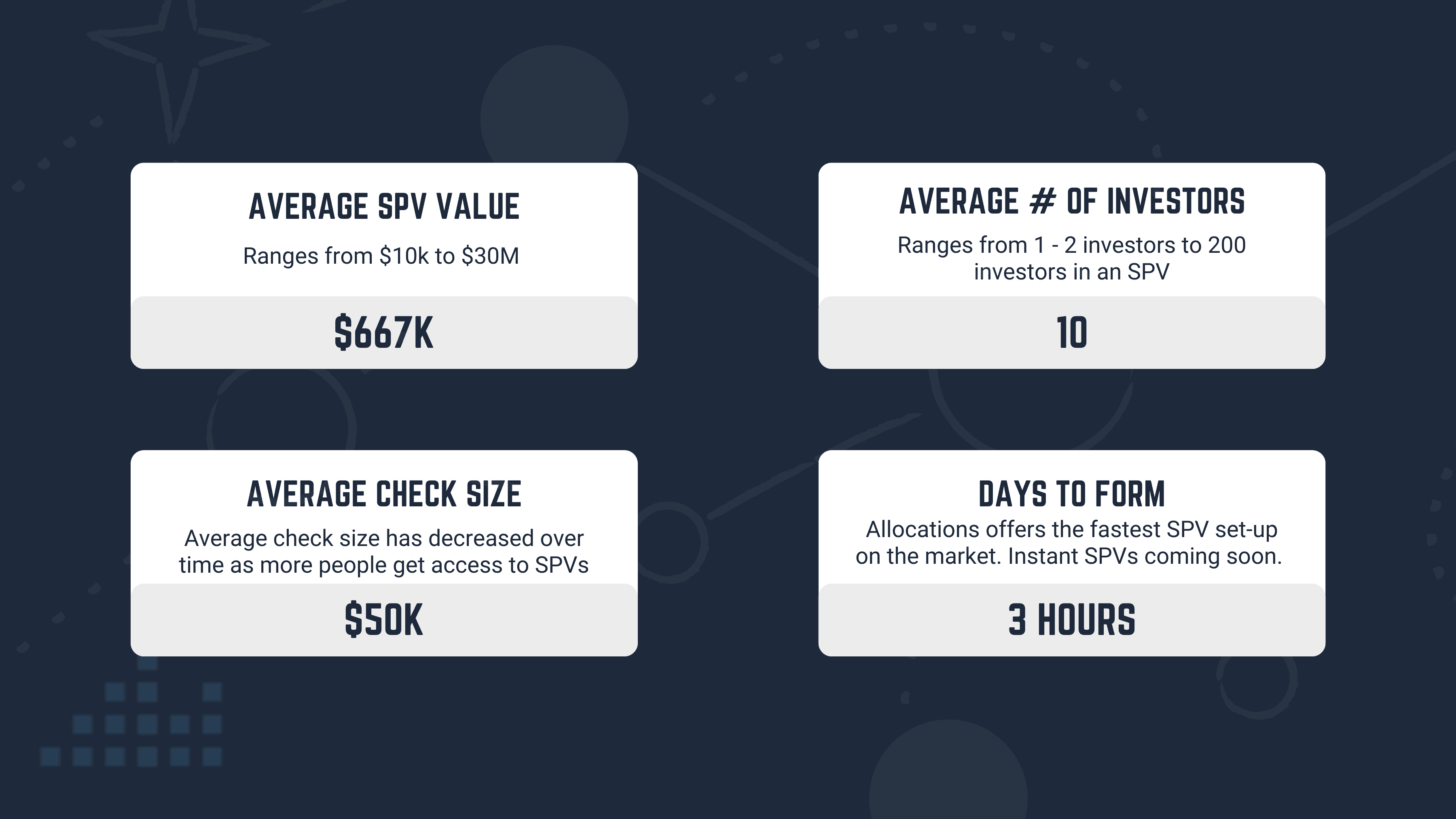

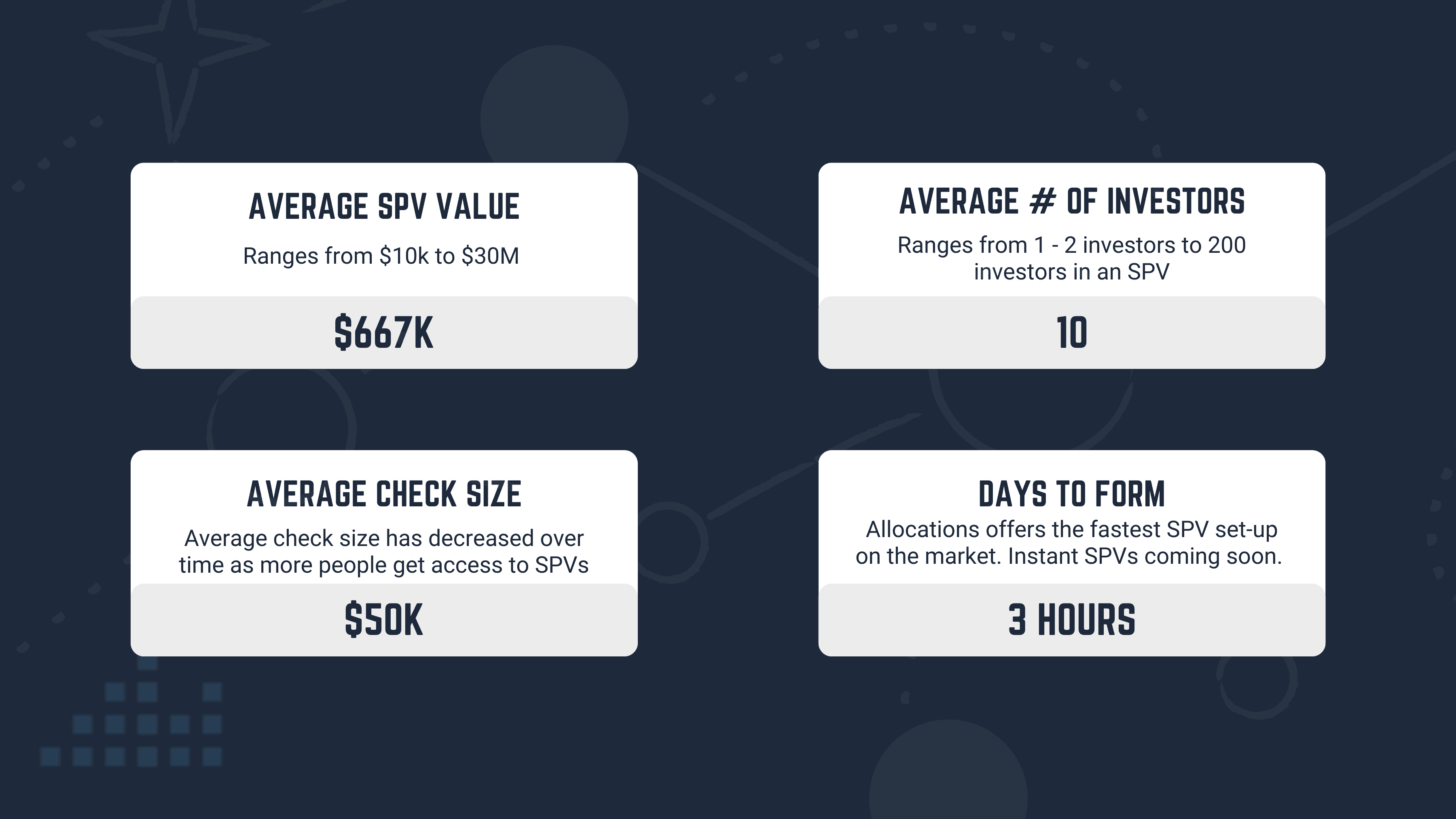

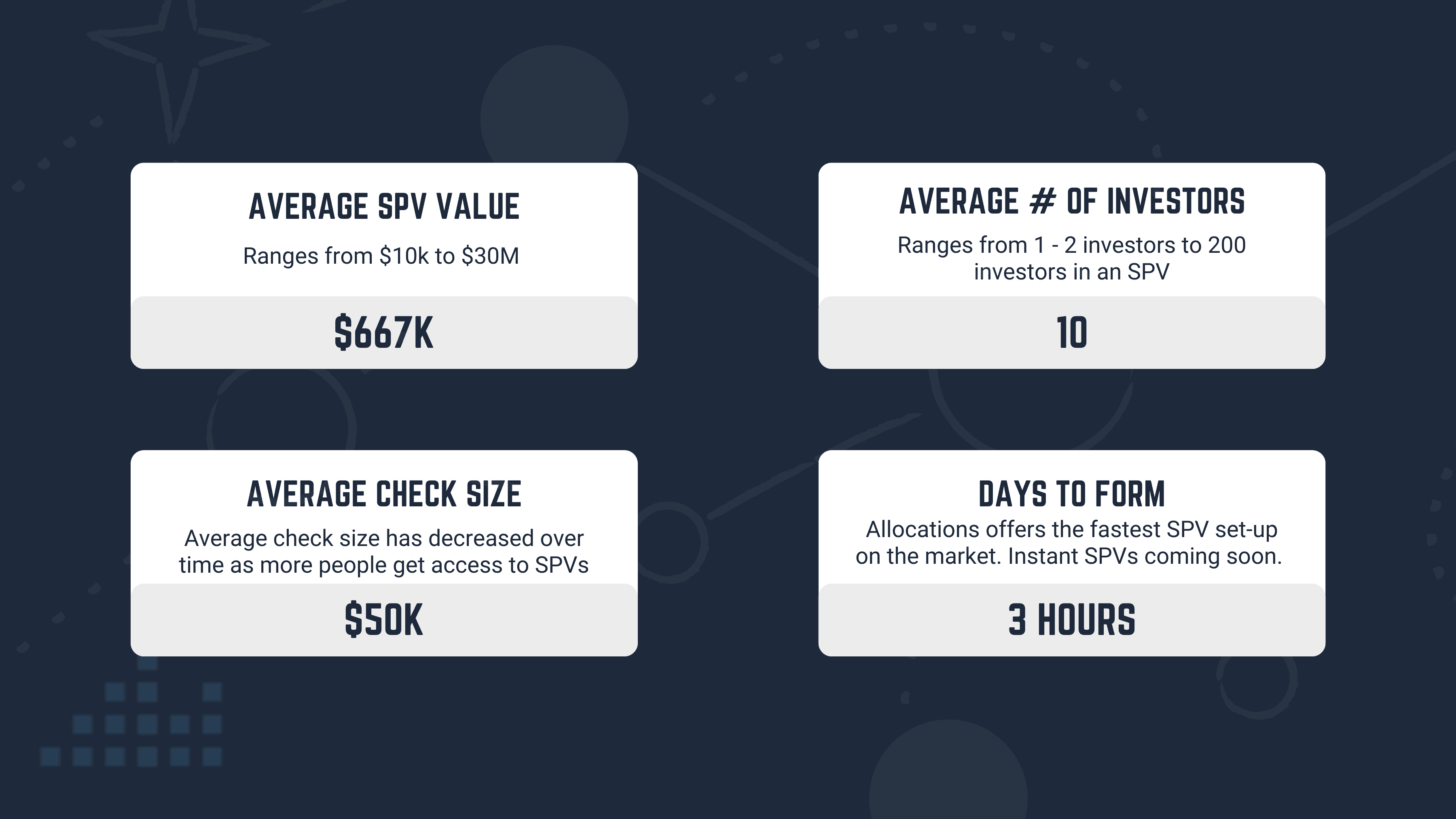

The average SPV size and average check size on Allocations has decreased over the past year. This demonstrates a shift to a more democratized economy through group investing.

So why are fund managers using SPVs?

Speed

Access to larger deals

Customization

Ease

As Allocations’ range of clients expands, so do the use cases of SPVs. Traditionally, SPVs are used for direct investments into early to late-stage start-ups. But through Allocations, investors have been able to use SPVs for more creative asset classes.

Here are 6 unique ways our clients have utilized SPVs through Allocations.

1. SPV in Fund

Typically, funds have high minimum check sizes - often $250K- $1M for smaller funds. Utilizing an SPV into a fund allows fund managers and angel groups to invest into deals they otherwise wouldn’t have access to.

Long Angle- a community of high net worth investors- have utilized SPVs through Allocations to invest into large funds by pooling capital to gain access to larger deals.

SPVs make it easy for angel groups, investor communities and fund managers to diversify and expand their portfolios to larger investments.

2. SPV in SPAC

A SPAC - also known as a "blank check company"- is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process.

Why would fund managers use SPVs to invest into a SPAC?

To provide access to investment opportunities for LPs and investors.

Let’s say for example there is an investment minimum for the main SPAC. Fund managers can set up an SPV, allowing them to accept smaller checks from investors who can’t meet the SPAC investment minimum.

Monterey Capital Acquisition Corp., a SPAC targeting the clean energy transition space, went public. Prithvi Ventures swiftly set up an SPV on Allocations and invested in Monterey Capital before its listing.

3. SPV into SPV

SPVs are becoming varied in size and more accessible to more investors. More recently, we’ve seen a trend of SPVs into SPVs- the ultimate democratization of private equity deals.

As we’ve seen with SPVs into funds or SPACs, this allows for aggregating smaller cheque investors (ex. scouts, employees, advisors, customers),specifically those that cannot meet the investment minimums of the primary SPV (which at times have a higher minimum investment requirement).

For example- there may be an SPV deal on the market with a minimum investment of $10M. A fund manager may build an SPV to invest into that SPV with investment minimums as low as $1,000. This lowers the barriers to access the original SPV and provides access to folks with lower investment capital.

Fund managers including Genesis Accel and Abbey Road have been able to structure these deals seamlessly and cost effectively through Allocations.

4. Real Estate SPV

Just as SPVs give investors access to more startups & companies, SPVs into Real Estate give investors access to larger real estate deals. Real Estate SPVs allow a group of investors to pool their capital and invest in properties that have investment minimums.

How have Allocations’ clients used SPVs to invest in real estate deals?

REETz Club's SPV into Driftwood Capital's offering of Hotel Rumbao

Long Angle’s SPV for an apartment community development in Denver, CO

Ben Way, founder of Rainmakers Inc, raised a $2M SPV to invest in a property development project in Tulum, Mexico

Fund managers are just beginning to scratch the surface of utilizing SPVs for real estate investments.

5. MicroSPV

Historically, fund managers would need to raise at least $1M to make an SPV cost efficient, but with the emergence of digital platforms like Allocations, fund managers can now use SPVs for much smaller group investments.

The smallest MicroSPV on Allocations was recently closed for a total amount of $10,000.

MicroSPVs open doors for a whole new group of smaller, diversified investors and LPs. As we continue to democratize private markets, we expect to see the average SPV size trend down as we power more MicroSPVs.

6. SPV into any asset class

These are just a few examples of how clients have used SPVs to invest in a variety of assets.

With full customization, Allocations can support SPVs into any asset class. Here are a few we've powered on our platform:

SPV in Acquisitions

SPV in LBO

SPV in Whiskey Asset

SPV in Aviation

SPV in Art

SPV in Public Stock

SPV in Trading Cards

SPV in Musical Instruments

SPV in Music & Art Festivals

SPV in Professional Sports Leagues

SPVs are a long term trend- one we see radically changing the landscape of private markets investing. We are still in the early adoption stage of SPVs- it’s likely there will be a rapid increase in use cases for SPVs on the market as angel groups, fund managers and investor communities begin to understand the benefits and power of SPVs.

Connect with our team to learn about custom SPVs and how you can get started today: allocations.com/schedule-demo

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Private markets are quickly evolving, creating both challenges and opportunities for fund managers and their investors. At the same time, Special Purpose Vehicles (SPVs) are becoming an important tool for private market participants.

Angel groups, solo GPs, emerging managers, family offices and investor communities are turning to SPVs to get deals done quickly and cost effectively.

Even institutional sized investors and large VCs are paying attention to SPVs- we predict that eventually these institutions will offer their clients access to SPVs in order to stay competitive.

Although SPVs have been around for a long time, they’ve become more cost effective over the past few years due to digital platforms such as Allocations. The use of SPVs opens up opportunities for investors of all sizes.

The average SPV size and average check size on Allocations has decreased over the past year. This demonstrates a shift to a more democratized economy through group investing.

So why are fund managers using SPVs?

Speed

Access to larger deals

Customization

Ease

As Allocations’ range of clients expands, so do the use cases of SPVs. Traditionally, SPVs are used for direct investments into early to late-stage start-ups. But through Allocations, investors have been able to use SPVs for more creative asset classes.

Here are 6 unique ways our clients have utilized SPVs through Allocations.

1. SPV in Fund

Typically, funds have high minimum check sizes - often $250K- $1M for smaller funds. Utilizing an SPV into a fund allows fund managers and angel groups to invest into deals they otherwise wouldn’t have access to.

Long Angle- a community of high net worth investors- have utilized SPVs through Allocations to invest into large funds by pooling capital to gain access to larger deals.

SPVs make it easy for angel groups, investor communities and fund managers to diversify and expand their portfolios to larger investments.

2. SPV in SPAC

A SPAC - also known as a "blank check company"- is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process.

Why would fund managers use SPVs to invest into a SPAC?

To provide access to investment opportunities for LPs and investors.

Let’s say for example there is an investment minimum for the main SPAC. Fund managers can set up an SPV, allowing them to accept smaller checks from investors who can’t meet the SPAC investment minimum.

Monterey Capital Acquisition Corp., a SPAC targeting the clean energy transition space, went public. Prithvi Ventures swiftly set up an SPV on Allocations and invested in Monterey Capital before its listing.

3. SPV into SPV

SPVs are becoming varied in size and more accessible to more investors. More recently, we’ve seen a trend of SPVs into SPVs- the ultimate democratization of private equity deals.

As we’ve seen with SPVs into funds or SPACs, this allows for aggregating smaller cheque investors (ex. scouts, employees, advisors, customers),specifically those that cannot meet the investment minimums of the primary SPV (which at times have a higher minimum investment requirement).

For example- there may be an SPV deal on the market with a minimum investment of $10M. A fund manager may build an SPV to invest into that SPV with investment minimums as low as $1,000. This lowers the barriers to access the original SPV and provides access to folks with lower investment capital.

Fund managers including Genesis Accel and Abbey Road have been able to structure these deals seamlessly and cost effectively through Allocations.

4. Real Estate SPV

Just as SPVs give investors access to more startups & companies, SPVs into Real Estate give investors access to larger real estate deals. Real Estate SPVs allow a group of investors to pool their capital and invest in properties that have investment minimums.

How have Allocations’ clients used SPVs to invest in real estate deals?

REETz Club's SPV into Driftwood Capital's offering of Hotel Rumbao

Long Angle’s SPV for an apartment community development in Denver, CO

Ben Way, founder of Rainmakers Inc, raised a $2M SPV to invest in a property development project in Tulum, Mexico

Fund managers are just beginning to scratch the surface of utilizing SPVs for real estate investments.

5. MicroSPV

Historically, fund managers would need to raise at least $1M to make an SPV cost efficient, but with the emergence of digital platforms like Allocations, fund managers can now use SPVs for much smaller group investments.

The smallest MicroSPV on Allocations was recently closed for a total amount of $10,000.

MicroSPVs open doors for a whole new group of smaller, diversified investors and LPs. As we continue to democratize private markets, we expect to see the average SPV size trend down as we power more MicroSPVs.

6. SPV into any asset class

These are just a few examples of how clients have used SPVs to invest in a variety of assets.

With full customization, Allocations can support SPVs into any asset class. Here are a few we've powered on our platform:

SPV in Acquisitions

SPV in LBO

SPV in Whiskey Asset

SPV in Aviation

SPV in Art

SPV in Public Stock

SPV in Trading Cards

SPV in Musical Instruments

SPV in Music & Art Festivals

SPV in Professional Sports Leagues

SPVs are a long term trend- one we see radically changing the landscape of private markets investing. We are still in the early adoption stage of SPVs- it’s likely there will be a rapid increase in use cases for SPVs on the market as angel groups, fund managers and investor communities begin to understand the benefits and power of SPVs.

Connect with our team to learn about custom SPVs and how you can get started today: allocations.com/schedule-demo

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Private markets are quickly evolving, creating both challenges and opportunities for fund managers and their investors. At the same time, Special Purpose Vehicles (SPVs) are becoming an important tool for private market participants.

Angel groups, solo GPs, emerging managers, family offices and investor communities are turning to SPVs to get deals done quickly and cost effectively.

Even institutional sized investors and large VCs are paying attention to SPVs- we predict that eventually these institutions will offer their clients access to SPVs in order to stay competitive.

Although SPVs have been around for a long time, they’ve become more cost effective over the past few years due to digital platforms such as Allocations. The use of SPVs opens up opportunities for investors of all sizes.

The average SPV size and average check size on Allocations has decreased over the past year. This demonstrates a shift to a more democratized economy through group investing.

So why are fund managers using SPVs?

Speed

Access to larger deals

Customization

Ease

As Allocations’ range of clients expands, so do the use cases of SPVs. Traditionally, SPVs are used for direct investments into early to late-stage start-ups. But through Allocations, investors have been able to use SPVs for more creative asset classes.

Here are 6 unique ways our clients have utilized SPVs through Allocations.

1. SPV in Fund

Typically, funds have high minimum check sizes - often $250K- $1M for smaller funds. Utilizing an SPV into a fund allows fund managers and angel groups to invest into deals they otherwise wouldn’t have access to.

Long Angle- a community of high net worth investors- have utilized SPVs through Allocations to invest into large funds by pooling capital to gain access to larger deals.

SPVs make it easy for angel groups, investor communities and fund managers to diversify and expand their portfolios to larger investments.

2. SPV in SPAC

A SPAC - also known as a "blank check company"- is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process.

Why would fund managers use SPVs to invest into a SPAC?

To provide access to investment opportunities for LPs and investors.

Let’s say for example there is an investment minimum for the main SPAC. Fund managers can set up an SPV, allowing them to accept smaller checks from investors who can’t meet the SPAC investment minimum.

Monterey Capital Acquisition Corp., a SPAC targeting the clean energy transition space, went public. Prithvi Ventures swiftly set up an SPV on Allocations and invested in Monterey Capital before its listing.

3. SPV into SPV

SPVs are becoming varied in size and more accessible to more investors. More recently, we’ve seen a trend of SPVs into SPVs- the ultimate democratization of private equity deals.

As we’ve seen with SPVs into funds or SPACs, this allows for aggregating smaller cheque investors (ex. scouts, employees, advisors, customers),specifically those that cannot meet the investment minimums of the primary SPV (which at times have a higher minimum investment requirement).

For example- there may be an SPV deal on the market with a minimum investment of $10M. A fund manager may build an SPV to invest into that SPV with investment minimums as low as $1,000. This lowers the barriers to access the original SPV and provides access to folks with lower investment capital.

Fund managers including Genesis Accel and Abbey Road have been able to structure these deals seamlessly and cost effectively through Allocations.

4. Real Estate SPV

Just as SPVs give investors access to more startups & companies, SPVs into Real Estate give investors access to larger real estate deals. Real Estate SPVs allow a group of investors to pool their capital and invest in properties that have investment minimums.

How have Allocations’ clients used SPVs to invest in real estate deals?

REETz Club's SPV into Driftwood Capital's offering of Hotel Rumbao

Long Angle’s SPV for an apartment community development in Denver, CO

Ben Way, founder of Rainmakers Inc, raised a $2M SPV to invest in a property development project in Tulum, Mexico

Fund managers are just beginning to scratch the surface of utilizing SPVs for real estate investments.

5. MicroSPV

Historically, fund managers would need to raise at least $1M to make an SPV cost efficient, but with the emergence of digital platforms like Allocations, fund managers can now use SPVs for much smaller group investments.

The smallest MicroSPV on Allocations was recently closed for a total amount of $10,000.

MicroSPVs open doors for a whole new group of smaller, diversified investors and LPs. As we continue to democratize private markets, we expect to see the average SPV size trend down as we power more MicroSPVs.

6. SPV into any asset class

These are just a few examples of how clients have used SPVs to invest in a variety of assets.

With full customization, Allocations can support SPVs into any asset class. Here are a few we've powered on our platform:

SPV in Acquisitions

SPV in LBO

SPV in Whiskey Asset

SPV in Aviation

SPV in Art

SPV in Public Stock

SPV in Trading Cards

SPV in Musical Instruments

SPV in Music & Art Festivals

SPV in Professional Sports Leagues

SPVs are a long term trend- one we see radically changing the landscape of private markets investing. We are still in the early adoption stage of SPVs- it’s likely there will be a rapid increase in use cases for SPVs on the market as angel groups, fund managers and investor communities begin to understand the benefits and power of SPVs.

Connect with our team to learn about custom SPVs and how you can get started today: allocations.com/schedule-demo

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc