Back

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

What if your kid’s favorite addicting snacks didn’t have sugar?

What if there were a Yelp for corporate suppliers?

What if someone re-imagined the outdated supply chain for flowers?

This is the future that Angeles Investors are helping build. But it’s not just great ideas that make them invest — it’s about who they invest in and why.

You see, Angeles Investors isn’t an angel group focused on an industry, product type, or business model.

Instead, they focus on finding, funding, and growing Hispanic and Latinx ventures. But you might ask:

How big is that market?

Is it viable?

Is it growing?

The numbers might surprise you …

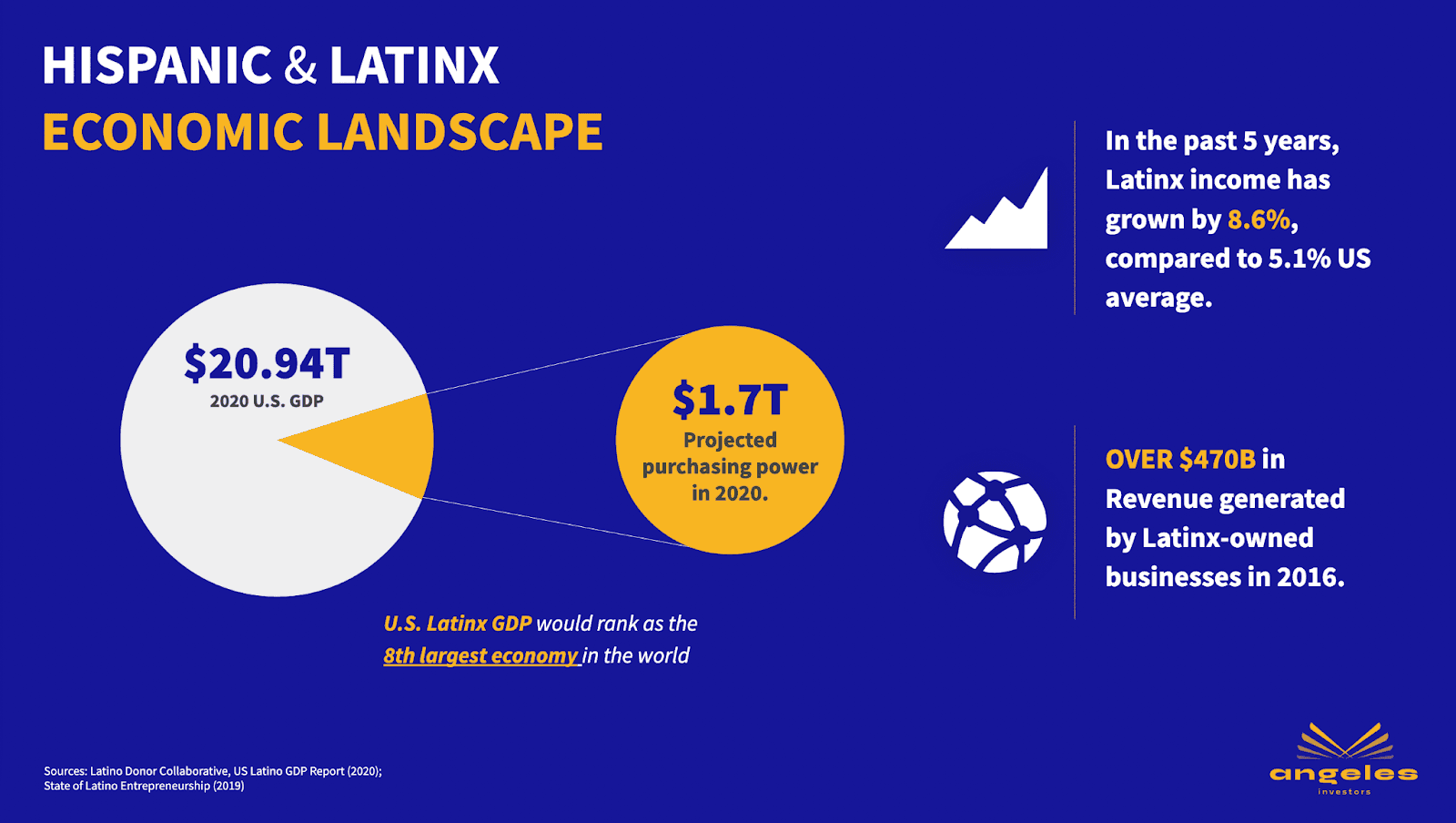

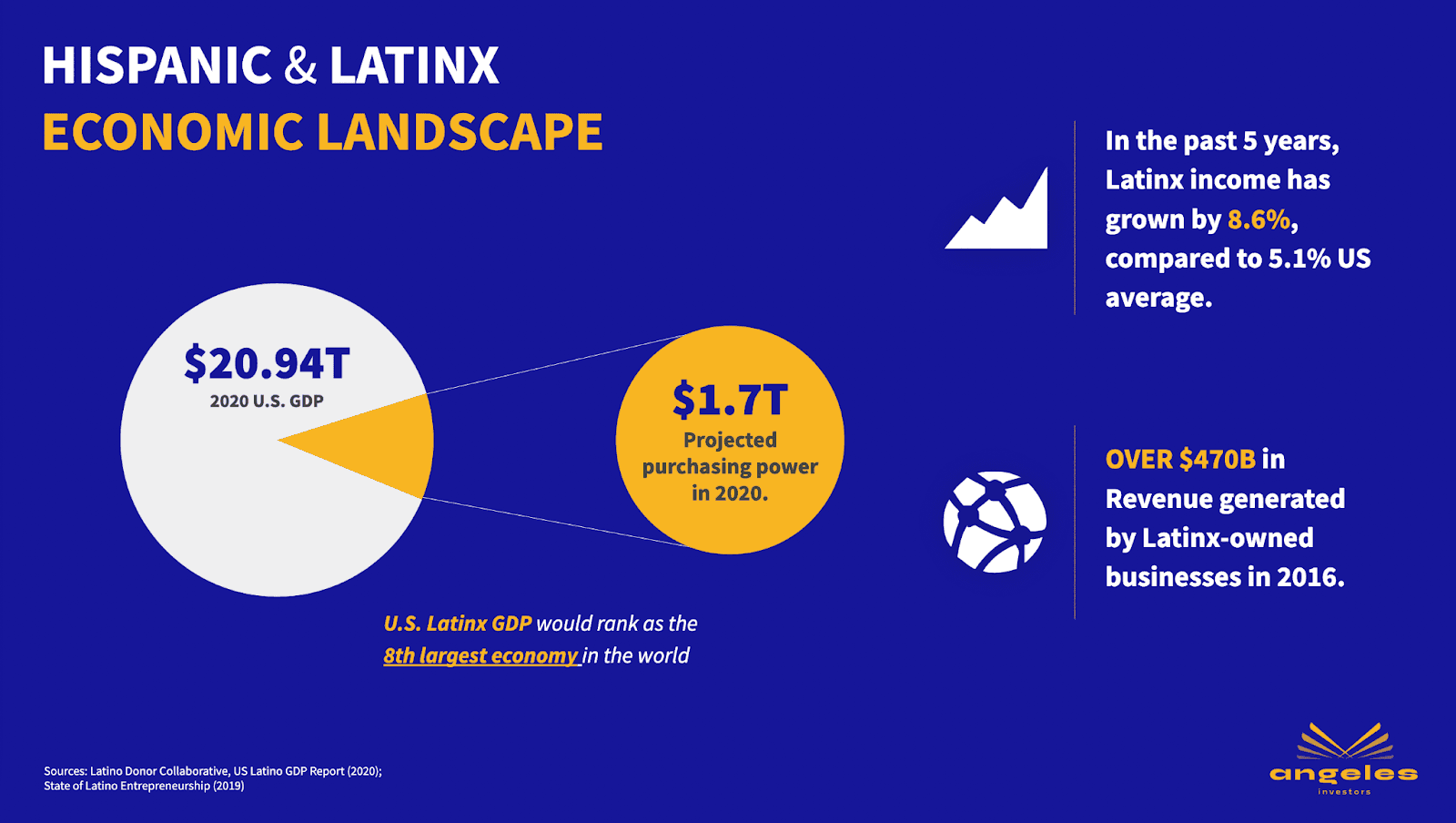

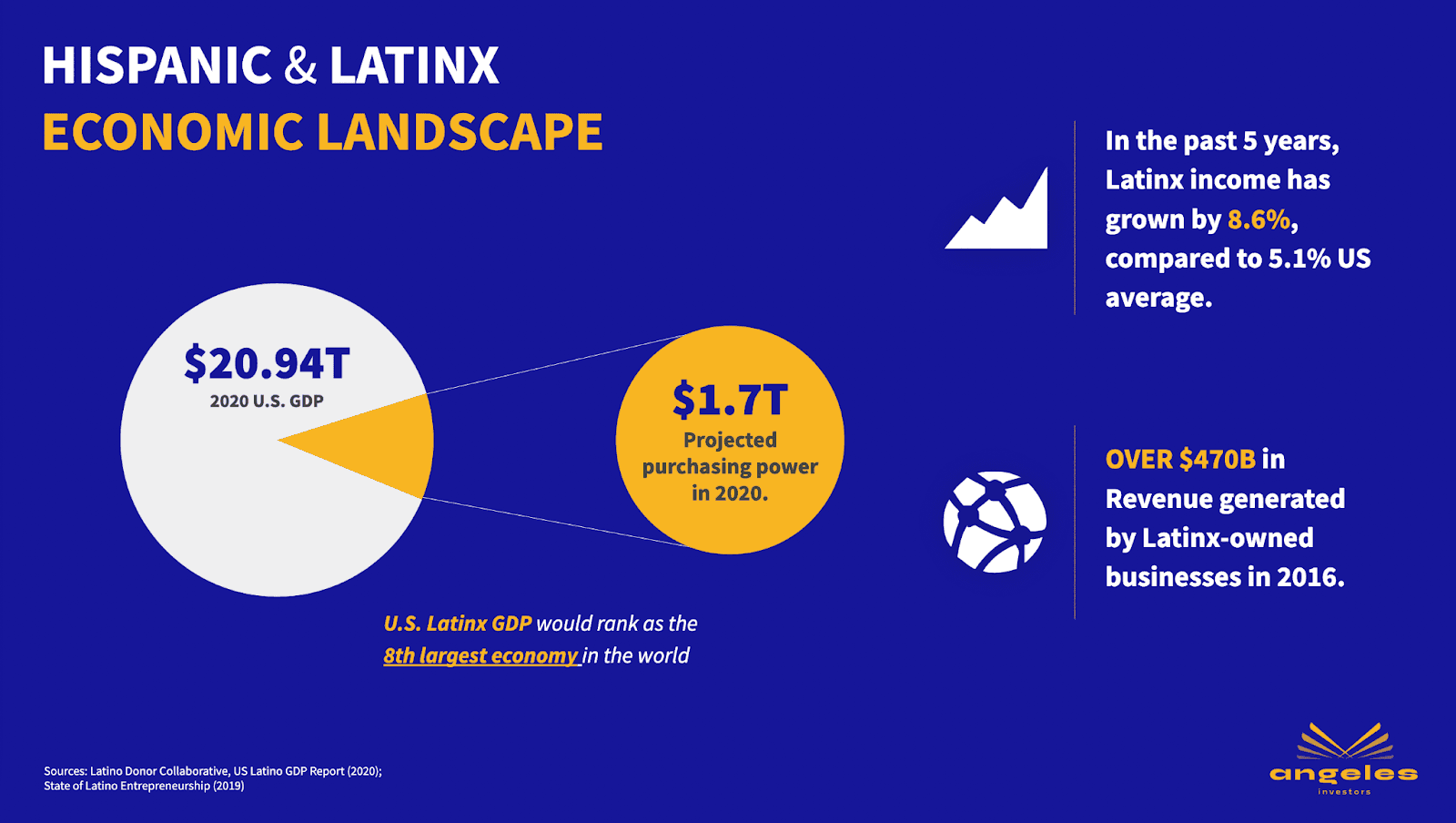

The Hispanic and Latinx Economic Opportunity

In the past 5 years, Latinx income has grown by 8.6%, compared to 5.1% US average.

To put this in perspective: if the US Latinx GDP were its own economy, it would be the 8th largest in the world!

But despite this growth and impact, they make up less than 2% of founders who receive VC funding — a number that’s too small to ignore for Angeles.

Data courtesy of the Latino Donor Collaborative, US Latino GDP Report (2020), and the State of Latino Entrepreneurship (2019)

What are Angeles Investors focused on?

Angeles Investors goals are simple:

Find, fund and grow the most promising Hispanic and Latinx ventures

Invest $12M into startups by 2023

Host pitch nights for investors to understand and network with founders

Focus on 6 key areas for Hispanic and Latinx founders and investors:

Foster the 1st generation of Hispanic and Latinx Angel Investors

Identify promising startups

Fill the capital gap for startups

Mentor and support ventures

Increase board representation

Build wealth

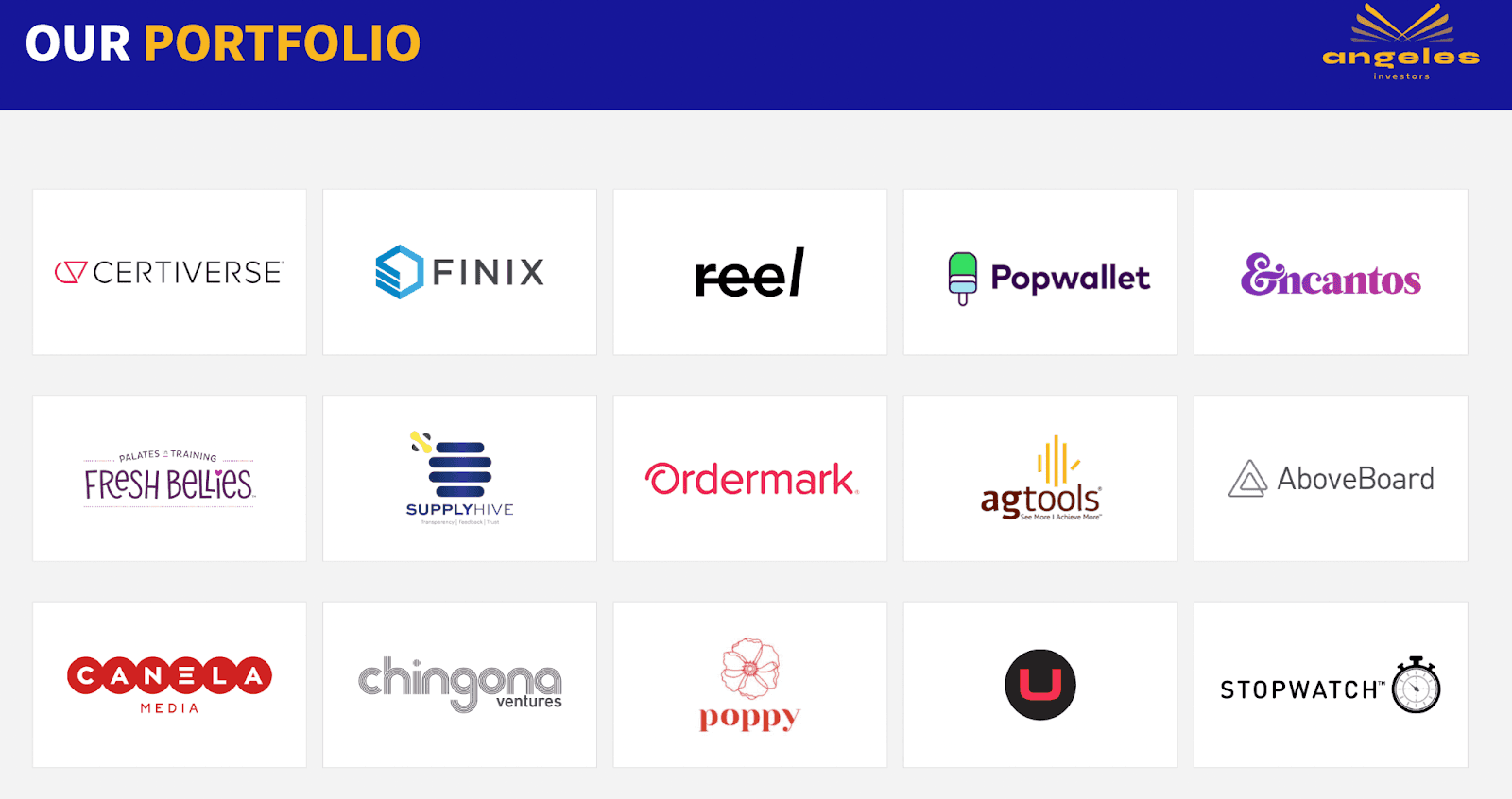

What are some of Angeles Investors portfolio companies?

We’ve mentioned 3 portfolio companies above but here’s a few more of the exciting startups Angeles Investors are proud to support:

Certiverse — launch exams faster

Finix — world-class payments experience for SaaS companies

Popwallet — mobile wallet customer experience management

Encantos — the storyteaching app kids love

Ordermark — online ordering for restaurants without the hassle

Agtools — worldwide real-time data for 500 specialty crops and commodities

AboveBoard — inclusive platform for executive hiring

Slide courtesy of the Angeles Investors Member deck

Why Allocations is proud to partner with Angeles Investors

Our mission at Allocations is to increase economic freedom.

This means activating more areas of the private markets that are underserved. And investing in investors doing the hard work on a daily basis.

We’re excited to fuel their growth and support their mission to find, fund, and grow the most promising Hispanic and Latinx ventures.

How can I join or get involved with Angeles Investors?

For startups, you can apply for funding.

For investors, check out their member qualifications.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

What if your kid’s favorite addicting snacks didn’t have sugar?

What if there were a Yelp for corporate suppliers?

What if someone re-imagined the outdated supply chain for flowers?

This is the future that Angeles Investors are helping build. But it’s not just great ideas that make them invest — it’s about who they invest in and why.

You see, Angeles Investors isn’t an angel group focused on an industry, product type, or business model.

Instead, they focus on finding, funding, and growing Hispanic and Latinx ventures. But you might ask:

How big is that market?

Is it viable?

Is it growing?

The numbers might surprise you …

The Hispanic and Latinx Economic Opportunity

In the past 5 years, Latinx income has grown by 8.6%, compared to 5.1% US average.

To put this in perspective: if the US Latinx GDP were its own economy, it would be the 8th largest in the world!

But despite this growth and impact, they make up less than 2% of founders who receive VC funding — a number that’s too small to ignore for Angeles.

Data courtesy of the Latino Donor Collaborative, US Latino GDP Report (2020), and the State of Latino Entrepreneurship (2019)

What are Angeles Investors focused on?

Angeles Investors goals are simple:

Find, fund and grow the most promising Hispanic and Latinx ventures

Invest $12M into startups by 2023

Host pitch nights for investors to understand and network with founders

Focus on 6 key areas for Hispanic and Latinx founders and investors:

Foster the 1st generation of Hispanic and Latinx Angel Investors

Identify promising startups

Fill the capital gap for startups

Mentor and support ventures

Increase board representation

Build wealth

What are some of Angeles Investors portfolio companies?

We’ve mentioned 3 portfolio companies above but here’s a few more of the exciting startups Angeles Investors are proud to support:

Certiverse — launch exams faster

Finix — world-class payments experience for SaaS companies

Popwallet — mobile wallet customer experience management

Encantos — the storyteaching app kids love

Ordermark — online ordering for restaurants without the hassle

Agtools — worldwide real-time data for 500 specialty crops and commodities

AboveBoard — inclusive platform for executive hiring

Slide courtesy of the Angeles Investors Member deck

Why Allocations is proud to partner with Angeles Investors

Our mission at Allocations is to increase economic freedom.

This means activating more areas of the private markets that are underserved. And investing in investors doing the hard work on a daily basis.

We’re excited to fuel their growth and support their mission to find, fund, and grow the most promising Hispanic and Latinx ventures.

How can I join or get involved with Angeles Investors?

For startups, you can apply for funding.

For investors, check out their member qualifications.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

What if your kid’s favorite addicting snacks didn’t have sugar?

What if there were a Yelp for corporate suppliers?

What if someone re-imagined the outdated supply chain for flowers?

This is the future that Angeles Investors are helping build. But it’s not just great ideas that make them invest — it’s about who they invest in and why.

You see, Angeles Investors isn’t an angel group focused on an industry, product type, or business model.

Instead, they focus on finding, funding, and growing Hispanic and Latinx ventures. But you might ask:

How big is that market?

Is it viable?

Is it growing?

The numbers might surprise you …

The Hispanic and Latinx Economic Opportunity

In the past 5 years, Latinx income has grown by 8.6%, compared to 5.1% US average.

To put this in perspective: if the US Latinx GDP were its own economy, it would be the 8th largest in the world!

But despite this growth and impact, they make up less than 2% of founders who receive VC funding — a number that’s too small to ignore for Angeles.

Data courtesy of the Latino Donor Collaborative, US Latino GDP Report (2020), and the State of Latino Entrepreneurship (2019)

What are Angeles Investors focused on?

Angeles Investors goals are simple:

Find, fund and grow the most promising Hispanic and Latinx ventures

Invest $12M into startups by 2023

Host pitch nights for investors to understand and network with founders

Focus on 6 key areas for Hispanic and Latinx founders and investors:

Foster the 1st generation of Hispanic and Latinx Angel Investors

Identify promising startups

Fill the capital gap for startups

Mentor and support ventures

Increase board representation

Build wealth

What are some of Angeles Investors portfolio companies?

We’ve mentioned 3 portfolio companies above but here’s a few more of the exciting startups Angeles Investors are proud to support:

Certiverse — launch exams faster

Finix — world-class payments experience for SaaS companies

Popwallet — mobile wallet customer experience management

Encantos — the storyteaching app kids love

Ordermark — online ordering for restaurants without the hassle

Agtools — worldwide real-time data for 500 specialty crops and commodities

AboveBoard — inclusive platform for executive hiring

Slide courtesy of the Angeles Investors Member deck

Why Allocations is proud to partner with Angeles Investors

Our mission at Allocations is to increase economic freedom.

This means activating more areas of the private markets that are underserved. And investing in investors doing the hard work on a daily basis.

We’re excited to fuel their growth and support their mission to find, fund, and grow the most promising Hispanic and Latinx ventures.

How can I join or get involved with Angeles Investors?

For startups, you can apply for funding.

For investors, check out their member qualifications.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc