Back

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Today’s fund managers compete on speed.

And when you’re building a fund, it’s important to get the small details right. The costs of getting the small details wrong can be immense.

A small (but important) detail about your fund is whether it’s a 506b or 506c fund.

For example, one type allows you to advertise your fund and meet new, potential investors through Twitter or social media. The other type forbids advertising of any kind.

The differences between a 506b and a 506c fund are small but they matter. And knowing these differences allows you to build, raise, and close your funds faster.

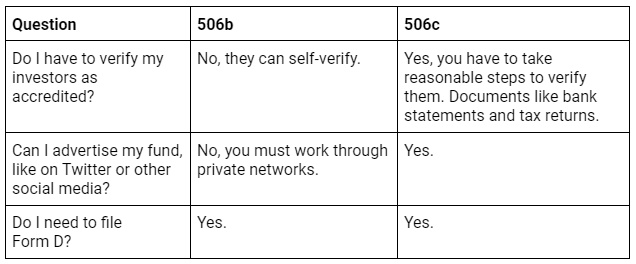

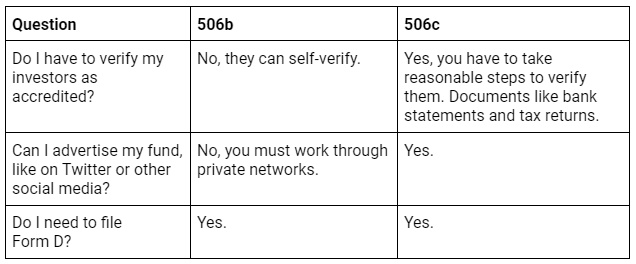

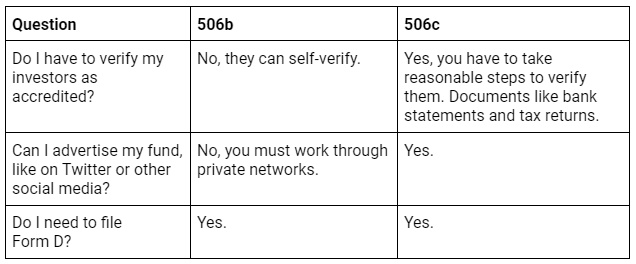

To start, here are the high-level differences between a 506b and a 506c fund.

1. FAQs about the difference between 506b and 506c funds

These are high-level questions with over-generalized answers. This table is by no means a source of authority.

It’s simply meant to illustrate some basic differences. These are the details we’d give you if we saw you in a coffee shop.

At Allocations, we adhere to the rules of the Investment Co. Act. We recommend you take a look at the Act if you’re going to make any important decisions about your funds.

2. What is Regulation D and why does it matter?

Regulation D (Reg D) is an SEC regulation that deals with the sale of stock shares or bonds to a small group of curated investors.

It doesn't concern companies offering equity in the public markets, like a stock exchange.

Reg D was created to help private companies raise money faster and cheaper, without having to register with the SEC (Securities and Exchange Commission). It allows the private company or startup to raise money through the sale of equity, which is an ownership percentage of the company or startup.

As a fund manager, Reg D is your friend because it allows you to place capital fast.

3. What is an accredited investor?

You’re an accredited investor if you meet at least one of these qualifications:

you have an individual or joint net worth more than $1M (this excludes the value of your primary residence)

you’ve had $200,000 income in each of the last two (2) years

you’ve had $300,000 joint income in each of the last two (2) years

you’re professional certification qualifies you as an accredited investor

you're a Director or Executive Officer of the Fund’s General Partner

you’re a knowledgeable employee of the private fund or its managers (this includes employees, executive directors, directors, trustees, and advisory board members. You also need to have at least 12 months tenure)

If you’re an entity, you must meet at least one of these qualifications:

each equity owner of your entity is an accredited investor

your entity has total assets worth more than $5M

you’re a “family office” with $5M+ assets under management (AUM)

you’re an Investment Advisor

you’re an Exempt Investment Adviser

you’re a private business development company

you’re an investment company or a business development company

you’re a Small Business Investment Company

4. What is a non-accredited investor?

Put simply, a non-accredited investor is the inverse of an accredited investor:

you do not have an individual or joint net worth more than $1M

you have not had $200,000 income in each of the last two (2) years

you have not had $300,000 joint income in each of the last two (2) years

you are not professional certification qualifies you as an accredited investor

you are not a Director or Executive Officer of the Fund’s General Partner

you are not a knowledgeable employee of the private fund or its managers

You may hear people refer to non-accredited investors as “retail investors” or “main street investors”. These terms are interchangeable.

5. Quick way to figure out which fund is right for you

Each fund and fund manager are unique.Here’s a basic test to figure out which type of fund may be right for your unique situation:506b funds may be better if …you have a robust network of investors to raise fromyou want to raise capital fastyou want to minimize costs506c funds may be better if …you have the time and resources to verify your investorsyou’d like to advertise your fundRegardless of your situation, Allocations can help you decide.10,000+ investors and fund managers build, raise, and close funds on Allocations — the fastest and most advanced fund platform in the world. Build your next SPV or Fund today

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Today’s fund managers compete on speed.

And when you’re building a fund, it’s important to get the small details right. The costs of getting the small details wrong can be immense.

A small (but important) detail about your fund is whether it’s a 506b or 506c fund.

For example, one type allows you to advertise your fund and meet new, potential investors through Twitter or social media. The other type forbids advertising of any kind.

The differences between a 506b and a 506c fund are small but they matter. And knowing these differences allows you to build, raise, and close your funds faster.

To start, here are the high-level differences between a 506b and a 506c fund.

1. FAQs about the difference between 506b and 506c funds

These are high-level questions with over-generalized answers. This table is by no means a source of authority.

It’s simply meant to illustrate some basic differences. These are the details we’d give you if we saw you in a coffee shop.

At Allocations, we adhere to the rules of the Investment Co. Act. We recommend you take a look at the Act if you’re going to make any important decisions about your funds.

2. What is Regulation D and why does it matter?

Regulation D (Reg D) is an SEC regulation that deals with the sale of stock shares or bonds to a small group of curated investors.

It doesn't concern companies offering equity in the public markets, like a stock exchange.

Reg D was created to help private companies raise money faster and cheaper, without having to register with the SEC (Securities and Exchange Commission). It allows the private company or startup to raise money through the sale of equity, which is an ownership percentage of the company or startup.

As a fund manager, Reg D is your friend because it allows you to place capital fast.

3. What is an accredited investor?

You’re an accredited investor if you meet at least one of these qualifications:

you have an individual or joint net worth more than $1M (this excludes the value of your primary residence)

you’ve had $200,000 income in each of the last two (2) years

you’ve had $300,000 joint income in each of the last two (2) years

you’re professional certification qualifies you as an accredited investor

you're a Director or Executive Officer of the Fund’s General Partner

you’re a knowledgeable employee of the private fund or its managers (this includes employees, executive directors, directors, trustees, and advisory board members. You also need to have at least 12 months tenure)

If you’re an entity, you must meet at least one of these qualifications:

each equity owner of your entity is an accredited investor

your entity has total assets worth more than $5M

you’re a “family office” with $5M+ assets under management (AUM)

you’re an Investment Advisor

you’re an Exempt Investment Adviser

you’re a private business development company

you’re an investment company or a business development company

you’re a Small Business Investment Company

4. What is a non-accredited investor?

Put simply, a non-accredited investor is the inverse of an accredited investor:

you do not have an individual or joint net worth more than $1M

you have not had $200,000 income in each of the last two (2) years

you have not had $300,000 joint income in each of the last two (2) years

you are not professional certification qualifies you as an accredited investor

you are not a Director or Executive Officer of the Fund’s General Partner

you are not a knowledgeable employee of the private fund or its managers

You may hear people refer to non-accredited investors as “retail investors” or “main street investors”. These terms are interchangeable.

5. Quick way to figure out which fund is right for you

Each fund and fund manager are unique.Here’s a basic test to figure out which type of fund may be right for your unique situation:506b funds may be better if …you have a robust network of investors to raise fromyou want to raise capital fastyou want to minimize costs506c funds may be better if …you have the time and resources to verify your investorsyou’d like to advertise your fundRegardless of your situation, Allocations can help you decide.10,000+ investors and fund managers build, raise, and close funds on Allocations — the fastest and most advanced fund platform in the world. Build your next SPV or Fund today

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Today’s fund managers compete on speed.

And when you’re building a fund, it’s important to get the small details right. The costs of getting the small details wrong can be immense.

A small (but important) detail about your fund is whether it’s a 506b or 506c fund.

For example, one type allows you to advertise your fund and meet new, potential investors through Twitter or social media. The other type forbids advertising of any kind.

The differences between a 506b and a 506c fund are small but they matter. And knowing these differences allows you to build, raise, and close your funds faster.

To start, here are the high-level differences between a 506b and a 506c fund.

1. FAQs about the difference between 506b and 506c funds

These are high-level questions with over-generalized answers. This table is by no means a source of authority.

It’s simply meant to illustrate some basic differences. These are the details we’d give you if we saw you in a coffee shop.

At Allocations, we adhere to the rules of the Investment Co. Act. We recommend you take a look at the Act if you’re going to make any important decisions about your funds.

2. What is Regulation D and why does it matter?

Regulation D (Reg D) is an SEC regulation that deals with the sale of stock shares or bonds to a small group of curated investors.

It doesn't concern companies offering equity in the public markets, like a stock exchange.

Reg D was created to help private companies raise money faster and cheaper, without having to register with the SEC (Securities and Exchange Commission). It allows the private company or startup to raise money through the sale of equity, which is an ownership percentage of the company or startup.

As a fund manager, Reg D is your friend because it allows you to place capital fast.

3. What is an accredited investor?

You’re an accredited investor if you meet at least one of these qualifications:

you have an individual or joint net worth more than $1M (this excludes the value of your primary residence)

you’ve had $200,000 income in each of the last two (2) years

you’ve had $300,000 joint income in each of the last two (2) years

you’re professional certification qualifies you as an accredited investor

you're a Director or Executive Officer of the Fund’s General Partner

you’re a knowledgeable employee of the private fund or its managers (this includes employees, executive directors, directors, trustees, and advisory board members. You also need to have at least 12 months tenure)

If you’re an entity, you must meet at least one of these qualifications:

each equity owner of your entity is an accredited investor

your entity has total assets worth more than $5M

you’re a “family office” with $5M+ assets under management (AUM)

you’re an Investment Advisor

you’re an Exempt Investment Adviser

you’re a private business development company

you’re an investment company or a business development company

you’re a Small Business Investment Company

4. What is a non-accredited investor?

Put simply, a non-accredited investor is the inverse of an accredited investor:

you do not have an individual or joint net worth more than $1M

you have not had $200,000 income in each of the last two (2) years

you have not had $300,000 joint income in each of the last two (2) years

you are not professional certification qualifies you as an accredited investor

you are not a Director or Executive Officer of the Fund’s General Partner

you are not a knowledgeable employee of the private fund or its managers

You may hear people refer to non-accredited investors as “retail investors” or “main street investors”. These terms are interchangeable.

5. Quick way to figure out which fund is right for you

Each fund and fund manager are unique.Here’s a basic test to figure out which type of fund may be right for your unique situation:506b funds may be better if …you have a robust network of investors to raise fromyou want to raise capital fastyou want to minimize costs506c funds may be better if …you have the time and resources to verify your investorsyou’d like to advertise your fundRegardless of your situation, Allocations can help you decide.10,000+ investors and fund managers build, raise, and close funds on Allocations — the fastest and most advanced fund platform in the world. Build your next SPV or Fund today

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc