Back

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

In Q1 of 2022, US VCs raised at an unparalleled rate. According to Pitchbook, more money was raised for new funds in this quarter than in the entirety of 2019.

However, this significant fundraising doesn’t exactly line up with the number of VC investments. We’ve seen a significant decrease in VC investments in Q1 of 2022. So while LPs may be slowing down, VC investments are expected to remain relatively stable due to the record-high amount of dry powder the market has ever seen.

Public market trends have historically been a good indicator of venture activity. Because of that, some believe VCs may face headwinds given the current movement of public markets.

But we predict that VCs, solo capitalists and angel investors will find opportunities in these 3 areas:

Microfunds & SPVs

Seed Deals & Secondary SPVs

Crypto

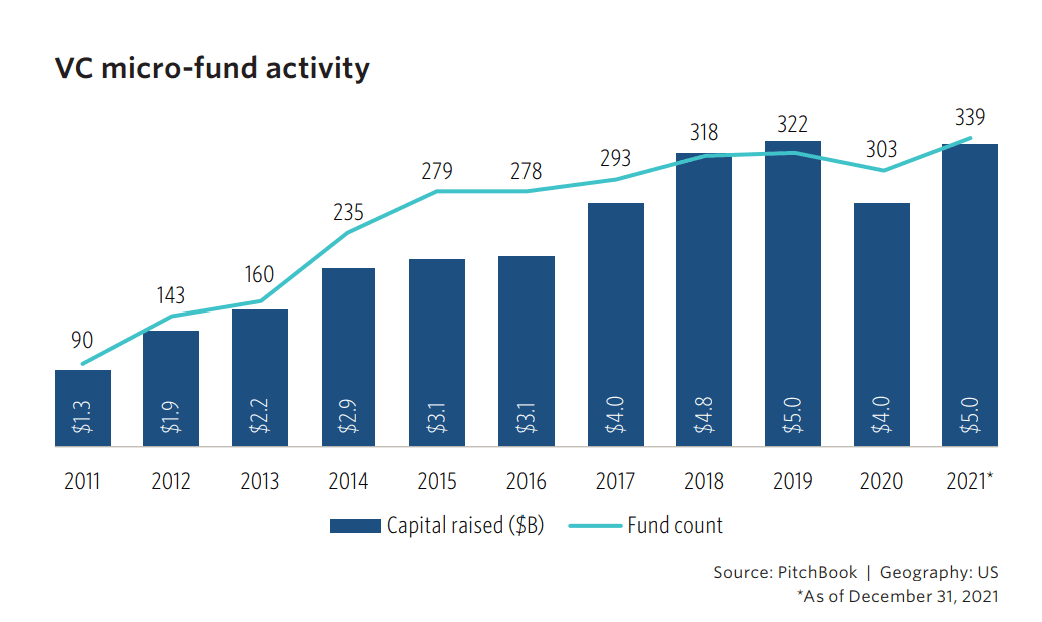

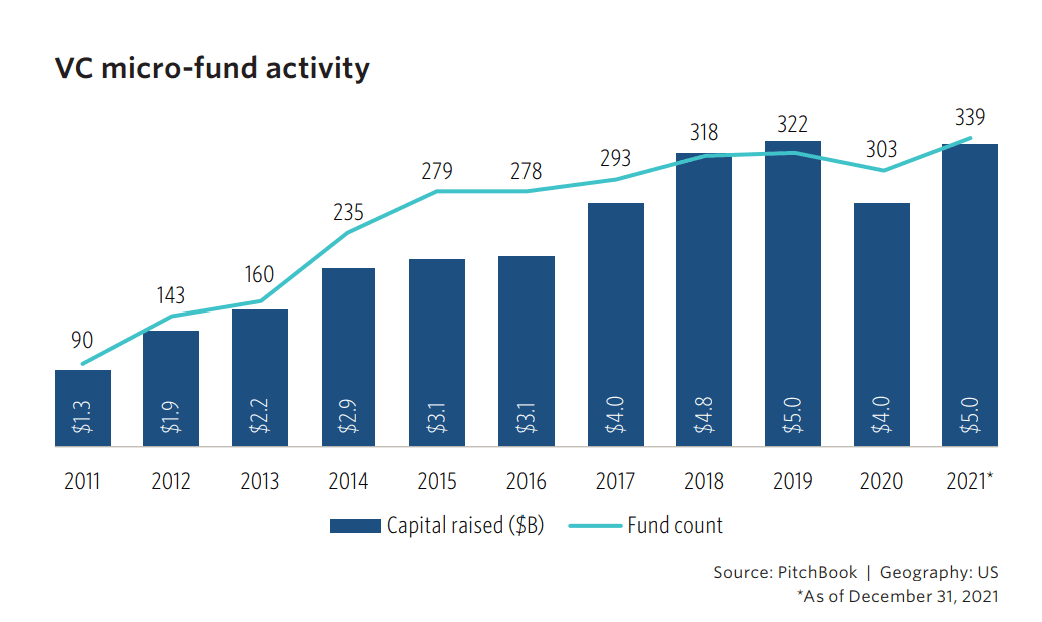

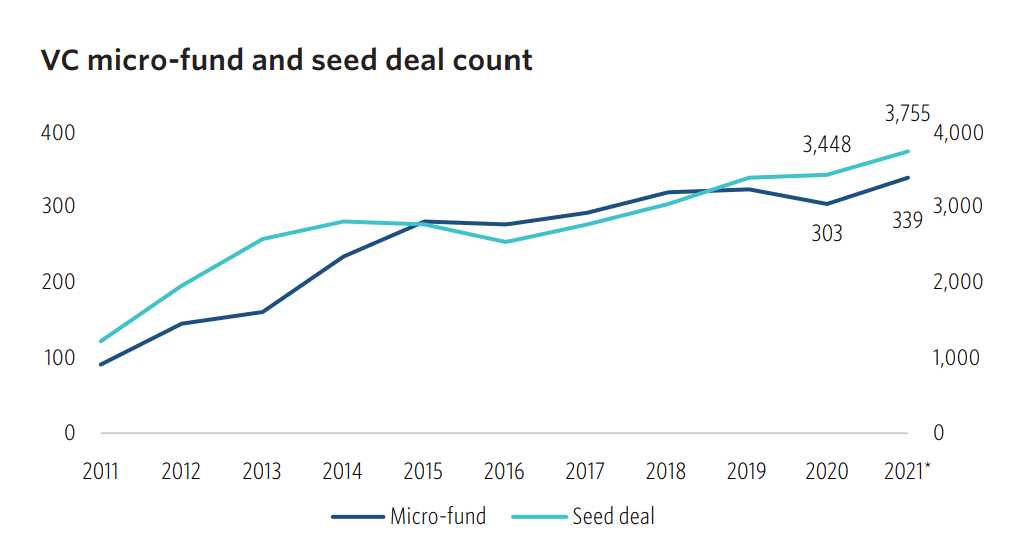

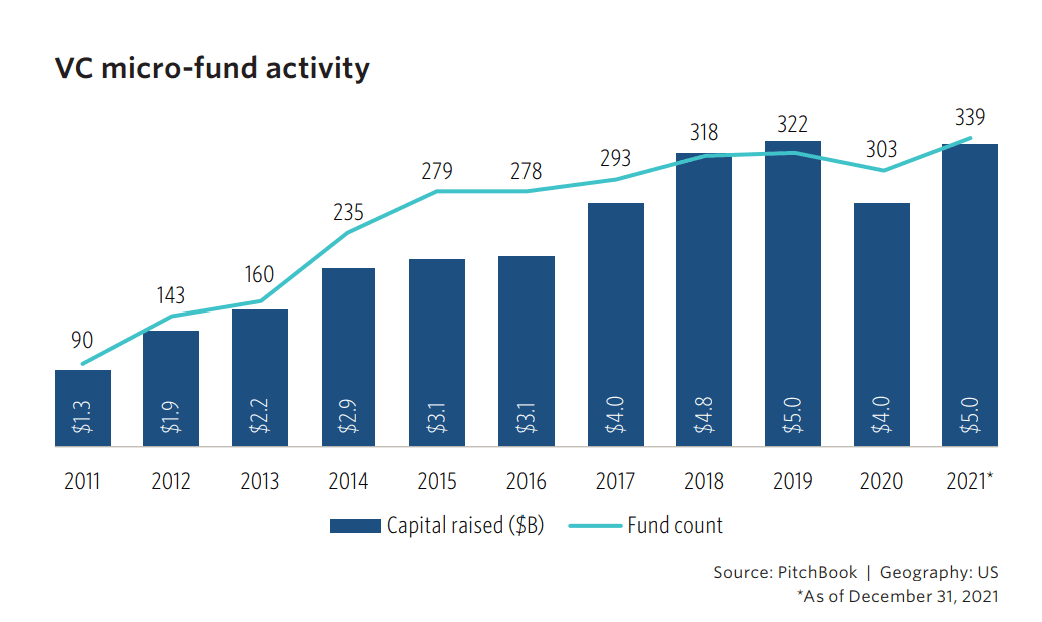

Micro-funds continue to be a rapidly growing vehicle.

The number of microfunds closed has grown from a tepid average of 75 per year between 2006 and 20011 to 320 between 2018 and 2020. And a record 339 micro-funds were closed in 2021.

Fund managers and solo capitalists use micro-funds and SPVs as a vehicle to adapt to the changing landscape and access new markets faster than ever. So as public markets remain in uncertainty, we expect to see even more fund managers take advantage of micro-funds and SPVs.

This April, Pitchbook released a report analyzing micro-funds and the direction they are trending:

“Despite the growing divide between micro-funds and the vehicles that drive the majority of venture fundraising in the US, these smaller vehicles have continued to drive trends from the beginnings of venture, and we believe they will continue to do so. Not only do they provide capital to the youngest companies, but they also offer benefits to the industry that larger funds cannot.”

SPVs and micro-funds create opportunities for solo capitalists and emerging VCs, providing access to more deals and allowing diversification.

“Micro-funds continue to proliferate in venture because, in many ways, they help democratize VC. Whether it be through increased opportunities to access the investment strategy, raise capital, or grow an investment firm or VC ecosystem, micro-funds offer keys to many.”

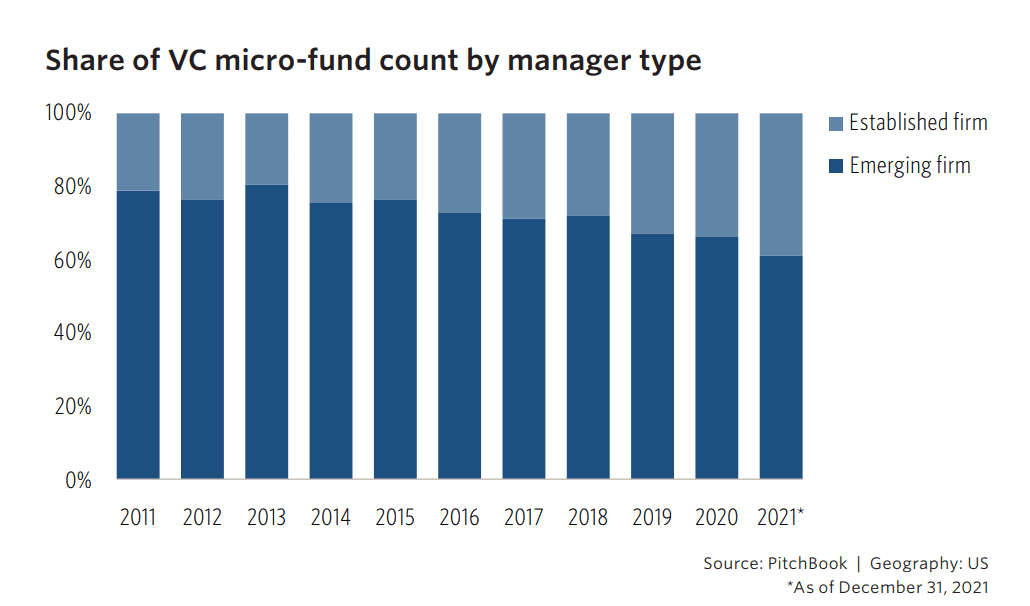

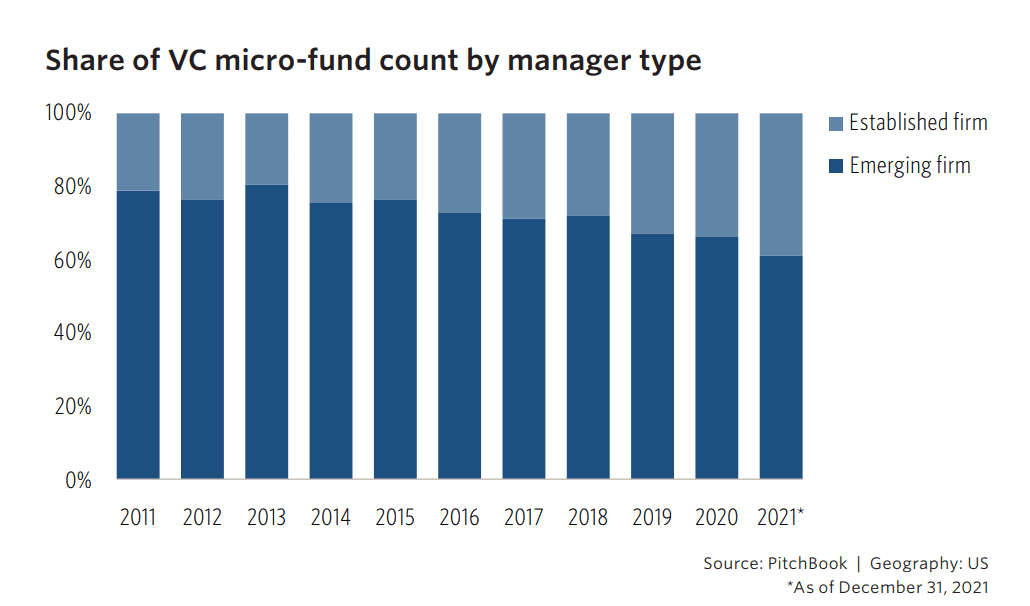

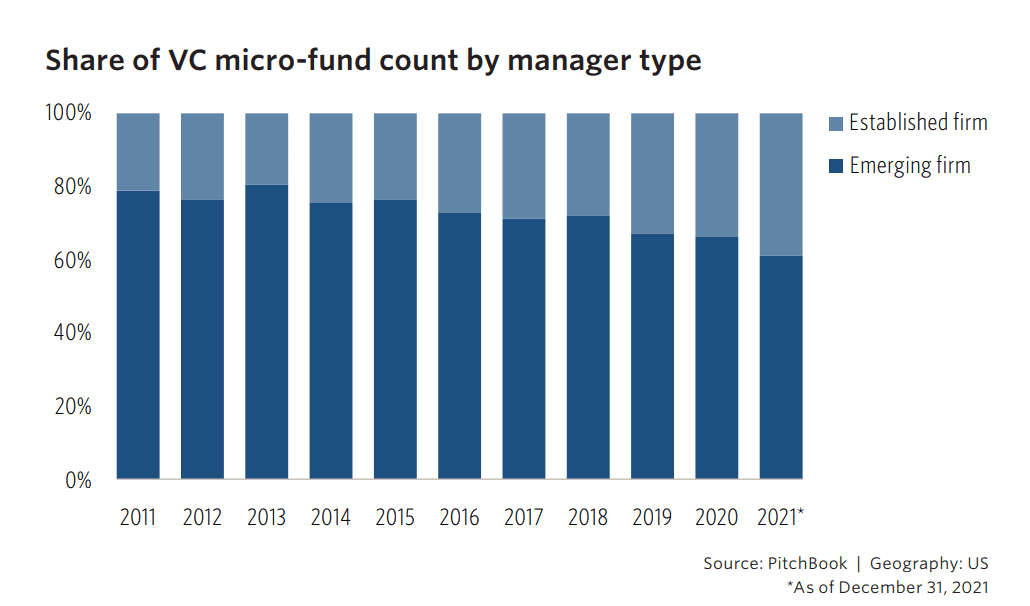

Historically, micro-funds and SPVs are most often raised by emerging managers. (Typically 60% of micro-funds—and in some years, more than 75%—are raised by emerging managers). But since 2011, we’ve seen a steady uptick in more established managers raising micro funds and SPVs.

However, it’s not only fund managers and investors who benefit from these smaller vehicles. There is a huge upside for founders and startups as well.

How are founders benefitting from SPVs?

Given that SPVs increase access to investors of all sizes, Founders are able to:

Invite small-check investors

Maintain their cap table in an efficient manner

Take the lead in ‘rolling-up’ their investors into an SPV

For example, Clubhouse in its recent Series B announcement, shared that it has over 180 investors in the company - many of which are small, independent investors that fit on a single-line on their cap table).

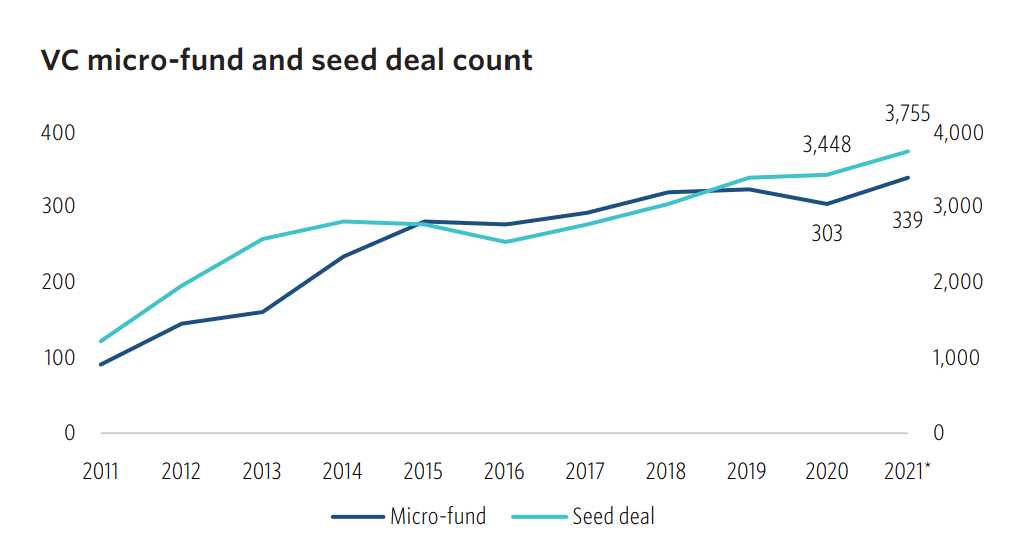

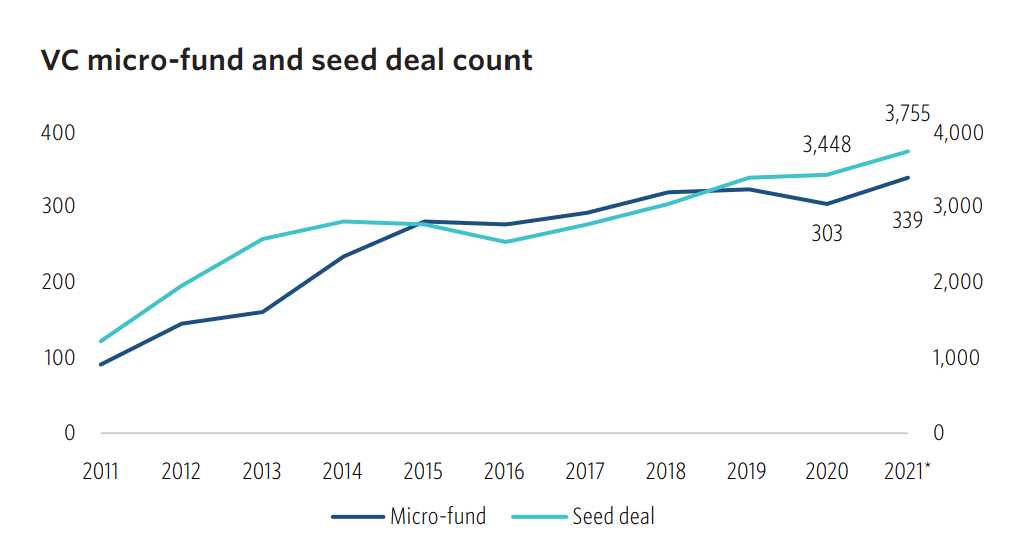

Micro-funds and SPVs often are most impactful at the seed stage- it allows emerging fund managers to engage more actively with founders while also diversifying.

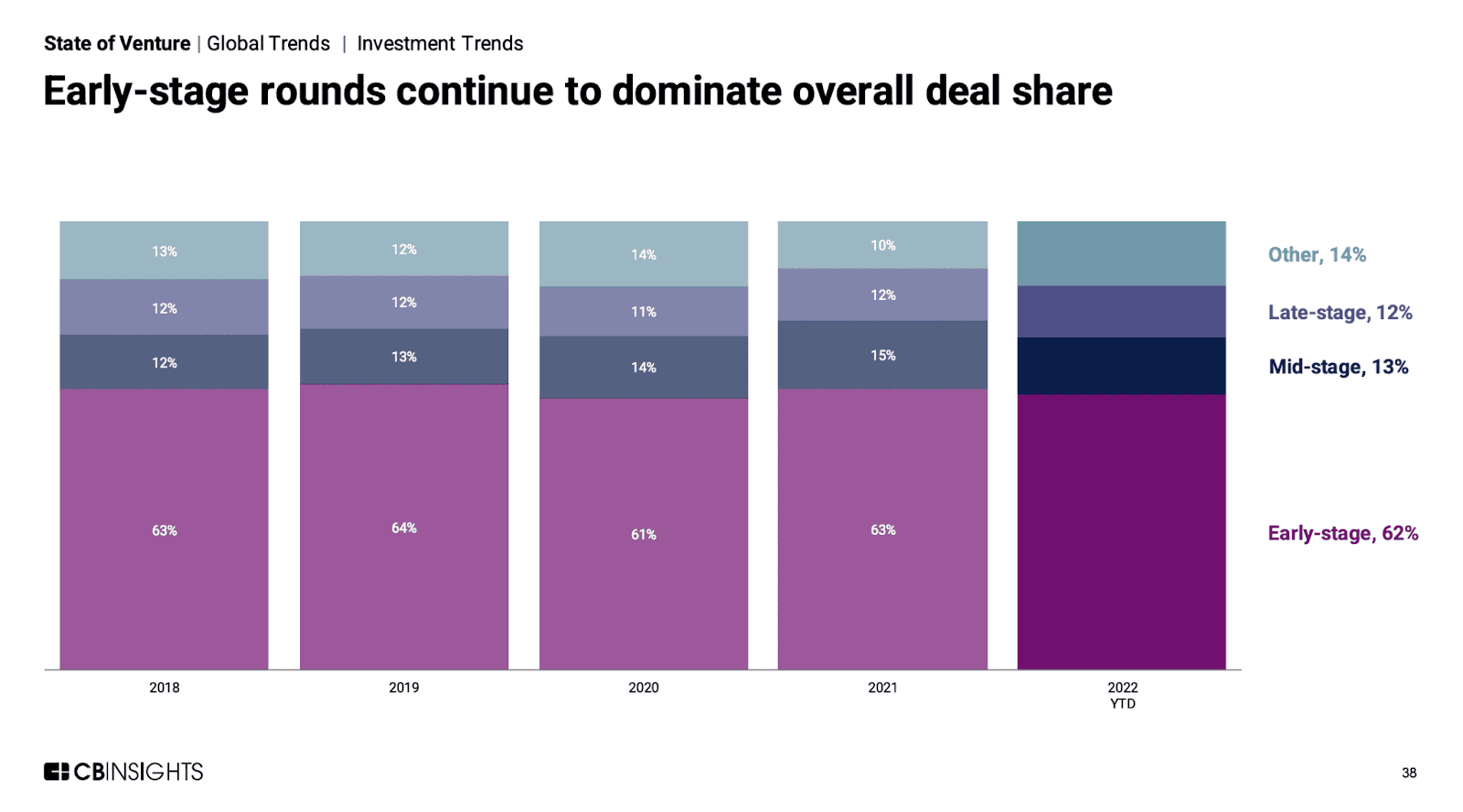

It's important to note the strong correlation between micro-funds and seed deals. And in 2022, we are continuing to see VCs pour capital into seed stage deals.

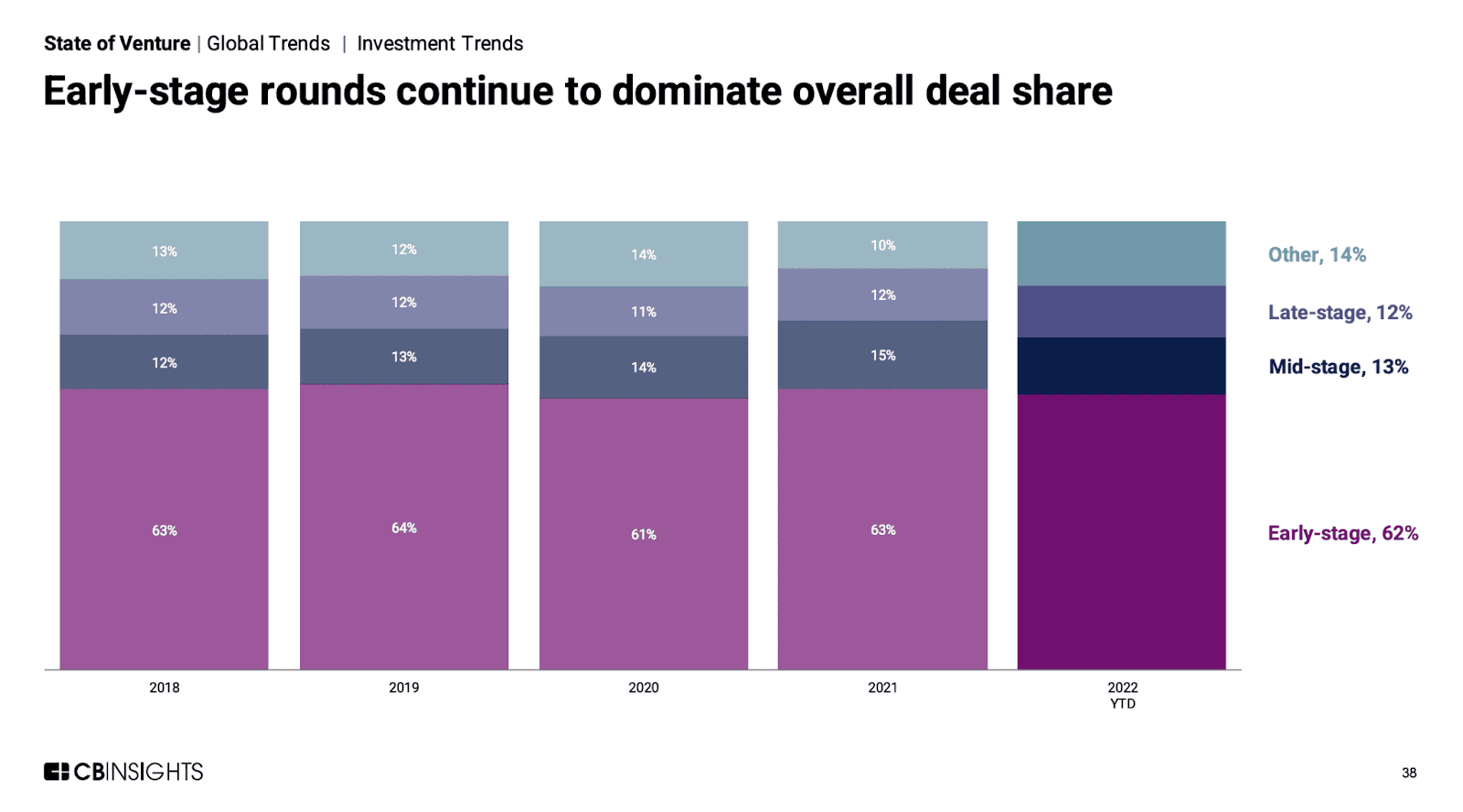

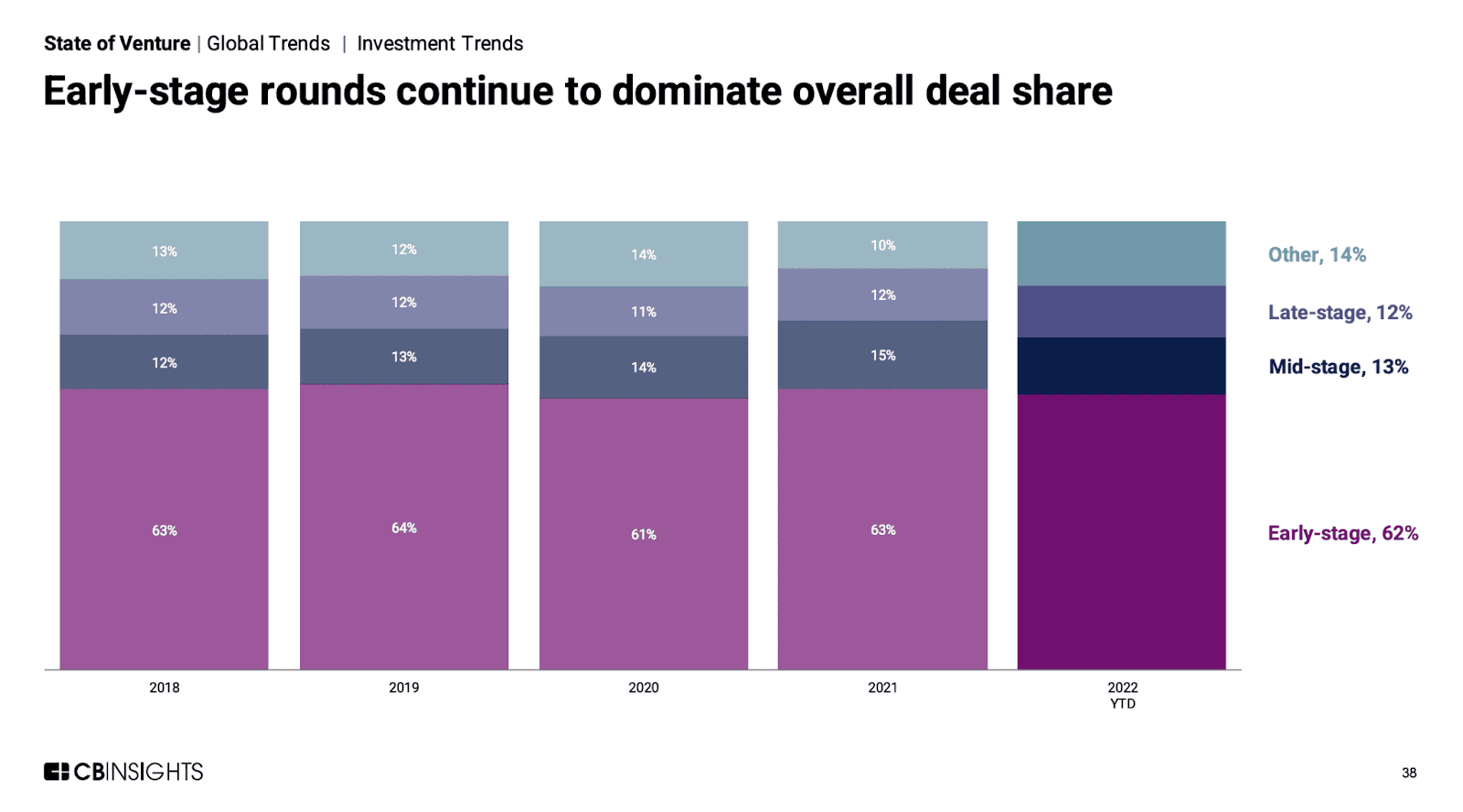

With angel and seed stage companies being furthest away from public markets, it’s likely there will be a high level of activity in early stage deals.

According to CB Insights early-stage deals continue to account for the majority of deals (60%) in 2022 YTD.

With the heavy focus on seed / angel investments, SPVs will help fund managers get deals done quickly in these early stage investments. Founders move quickly, especially when the company is at the seed stage of funding. Angel groups and fund managers will lean on SPVs to keep up and avoid missing out on deals.

Large VCs have already started to allocate a portion of their capital to seed deals. In 2021, Andressen Horowitz raised a $400M fund specifically for seed deals and Greylock announced a $500M fund dedicated to seed investing.

“We are seeing later-stage firms move earlier as they recognize the opportunity in seed.” says Sarah Hodges, a partner at Pillar VC.

Fund managers will also likely look to secondary SPVs. This is where investors purchase existing shares from current shareholders in a company.

Why would shareholders sell early?

With the public markets unstable, many private companies will likely remain private longer than expected. Shareholders who are looking to liquidate quickly can do so though secondaries.This creates a valuable opportunity for fund managers and investors to invest in companies they may have previously missed the opportunity on.

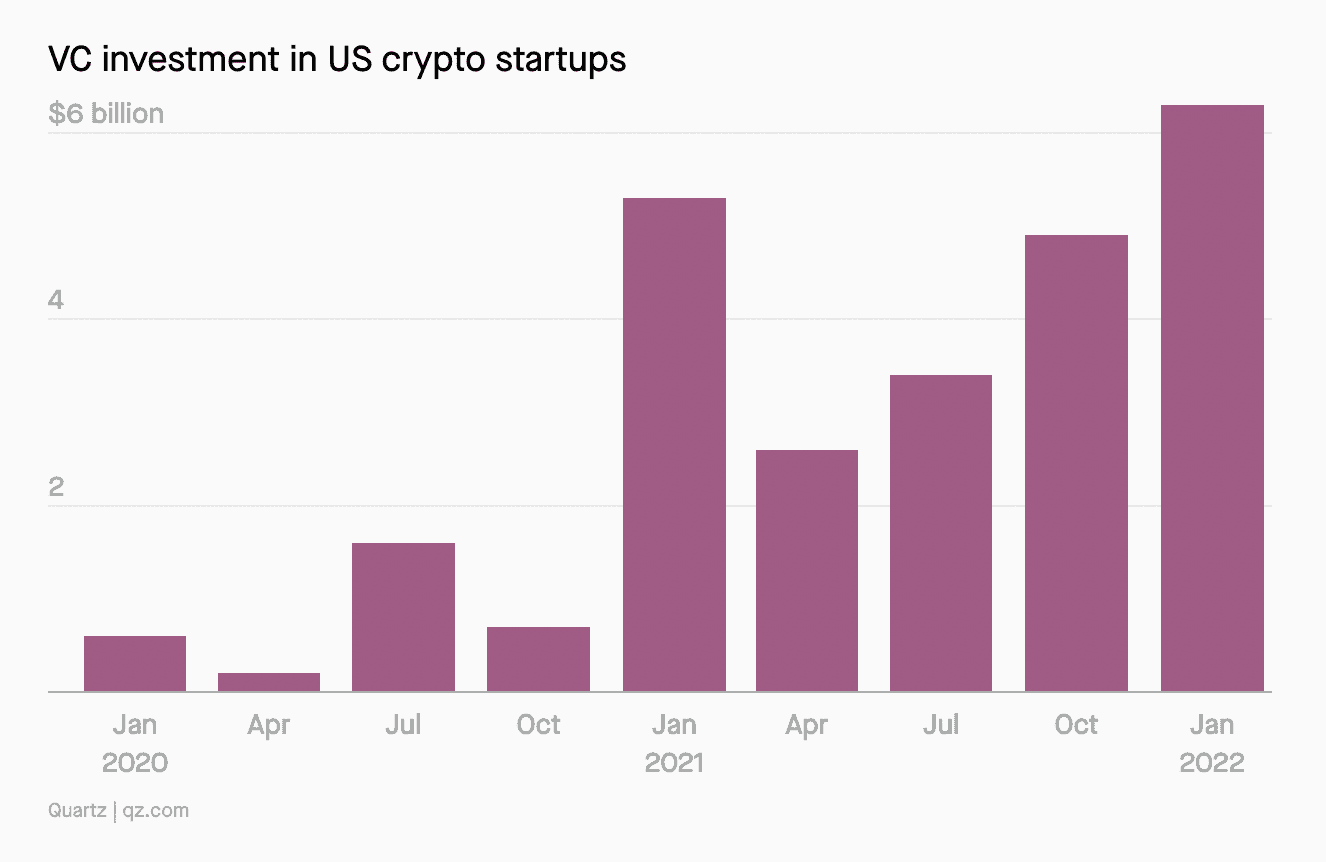

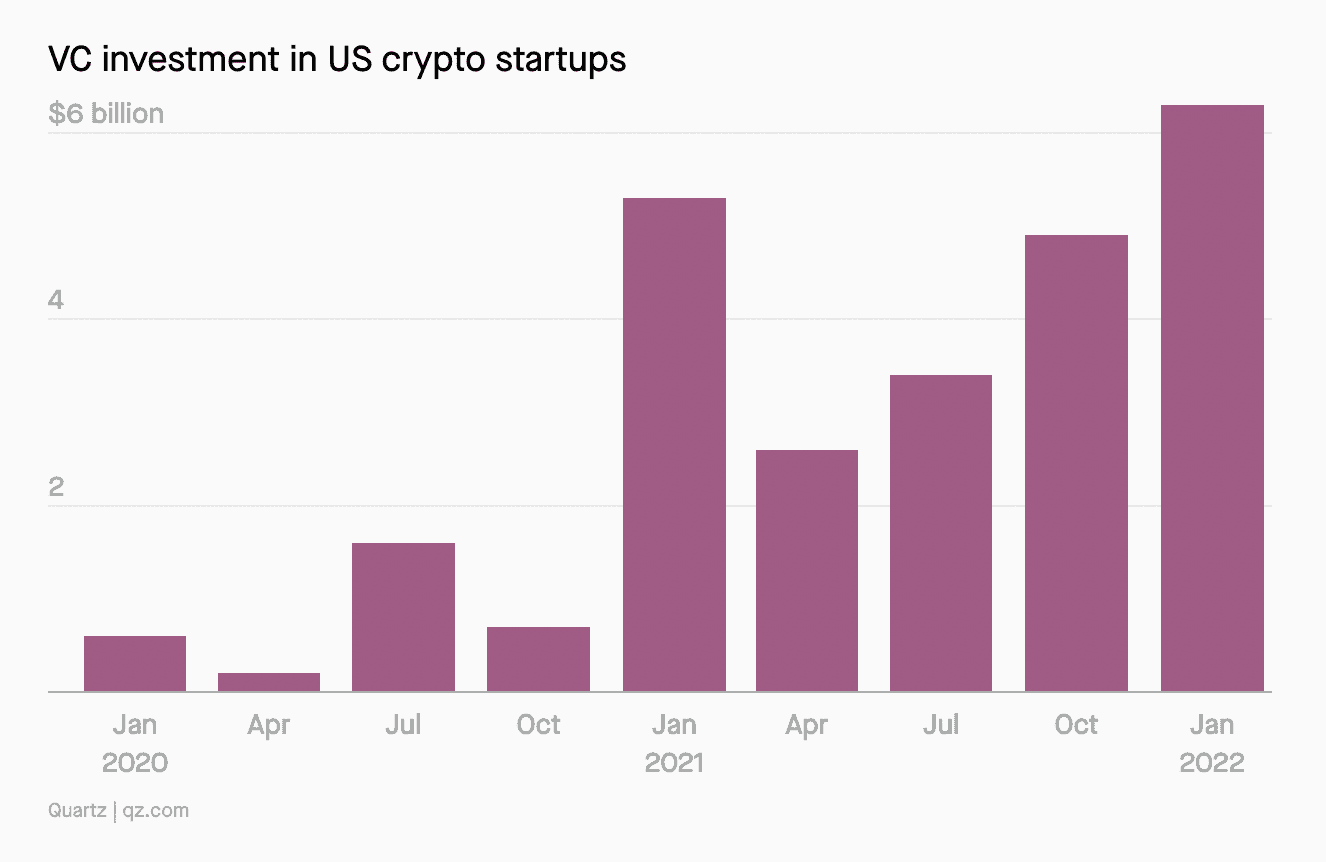

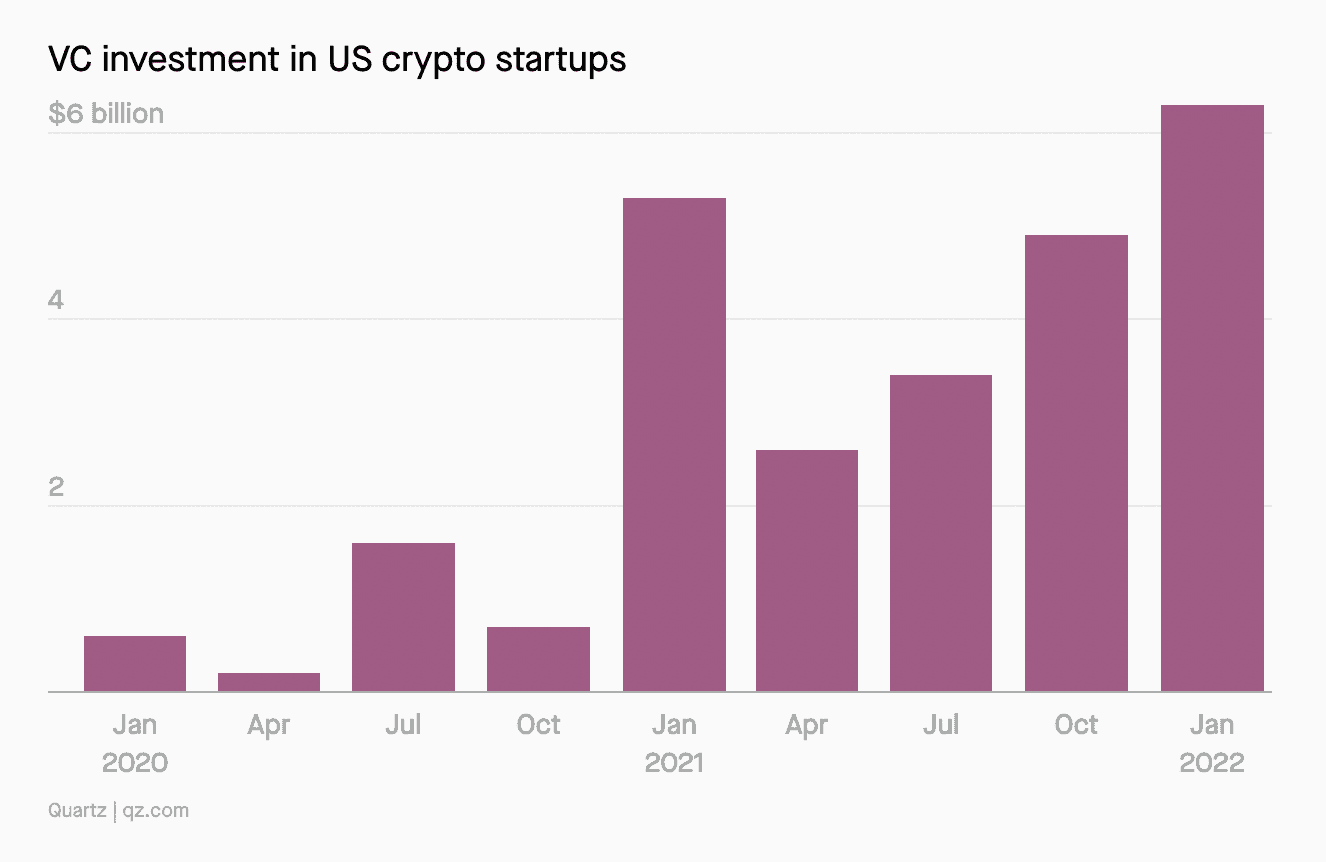

And of course, it would be impossible to discuss the trends of 2022 without mentioning crypto.

We’ve already seen VC firms increasingly back more crypto projects, and especially with institutional adoption of crypto on the rise, we expect to see fundraising for crypto startups continue to grow.

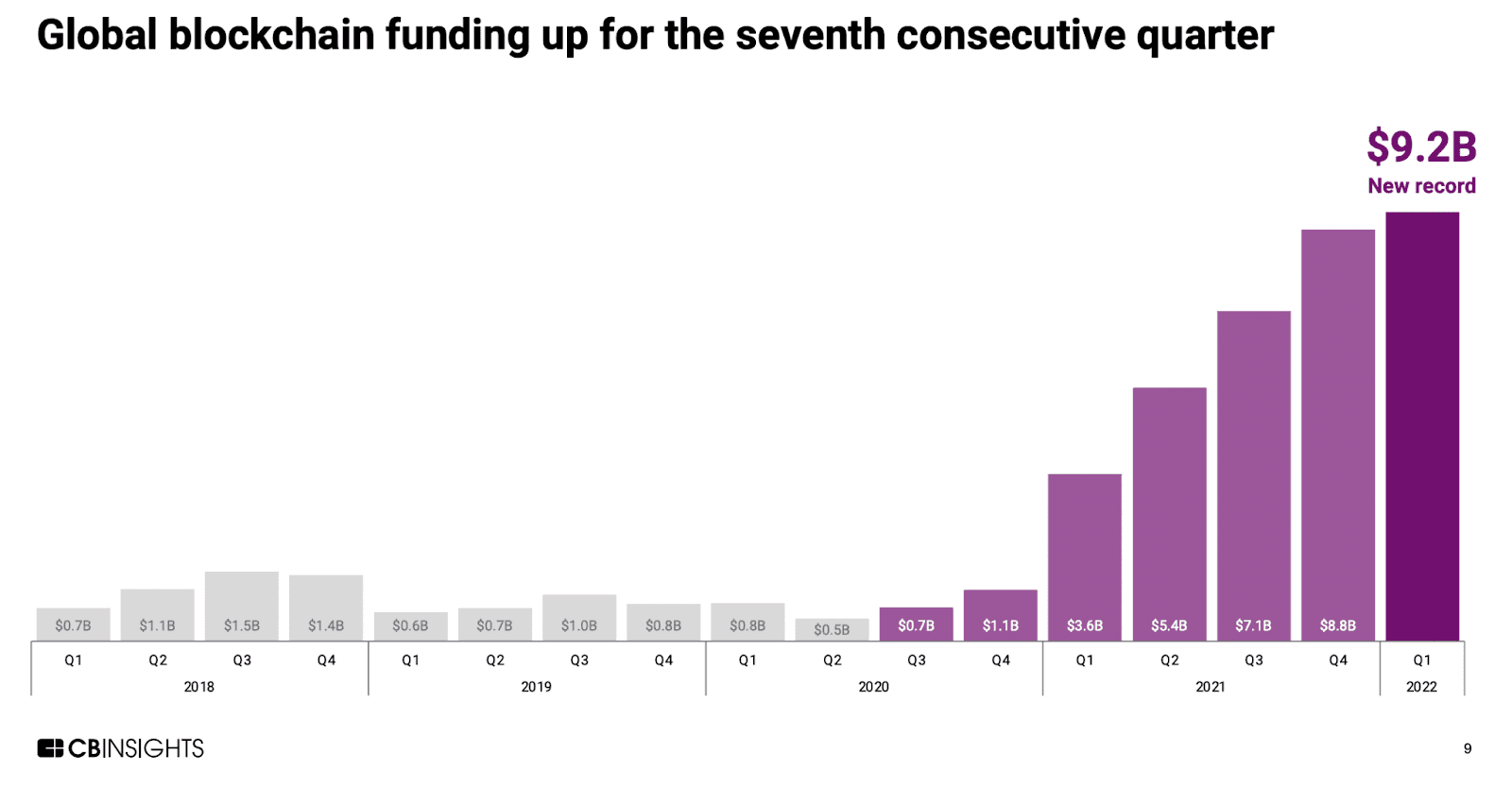

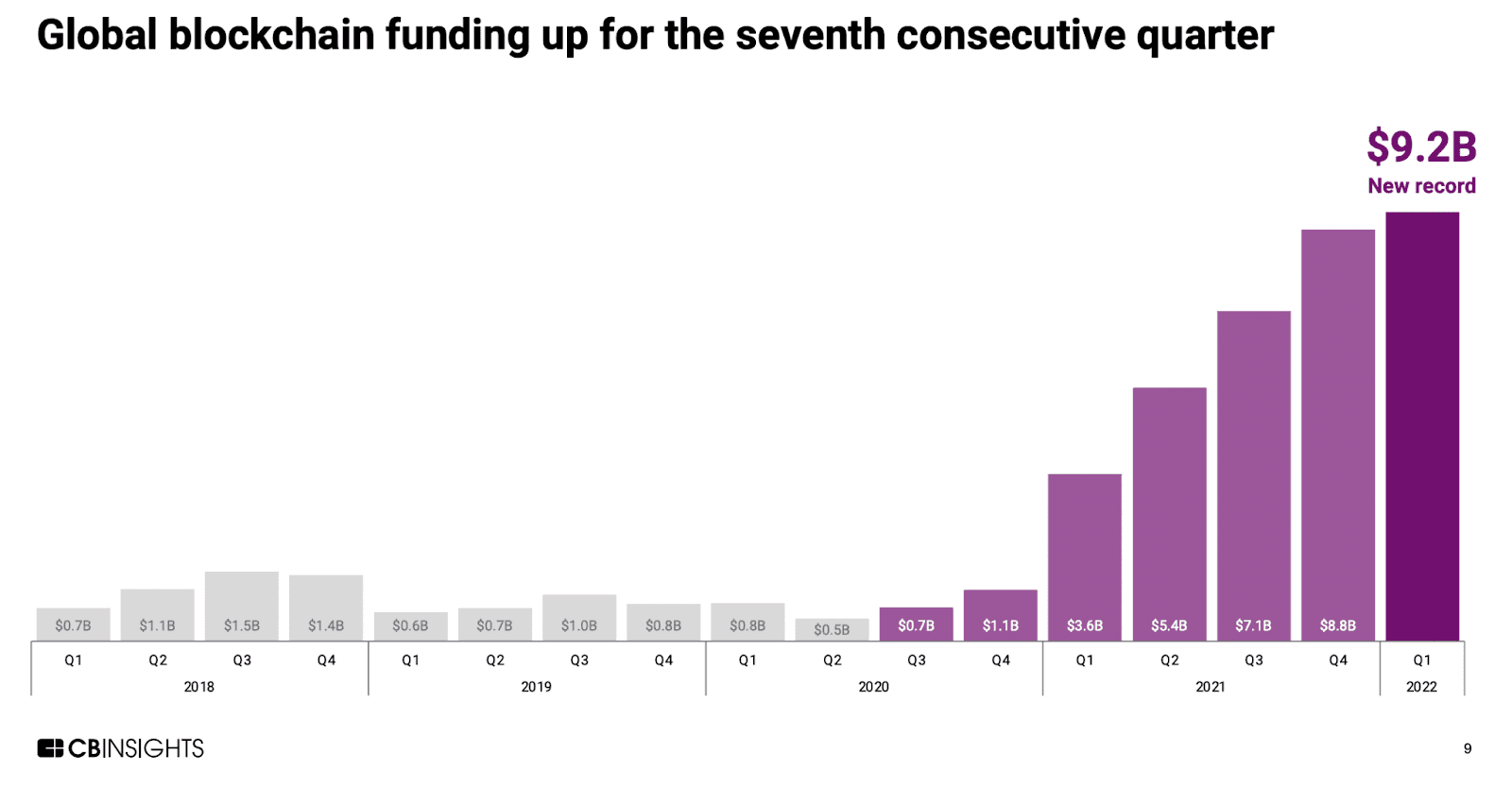

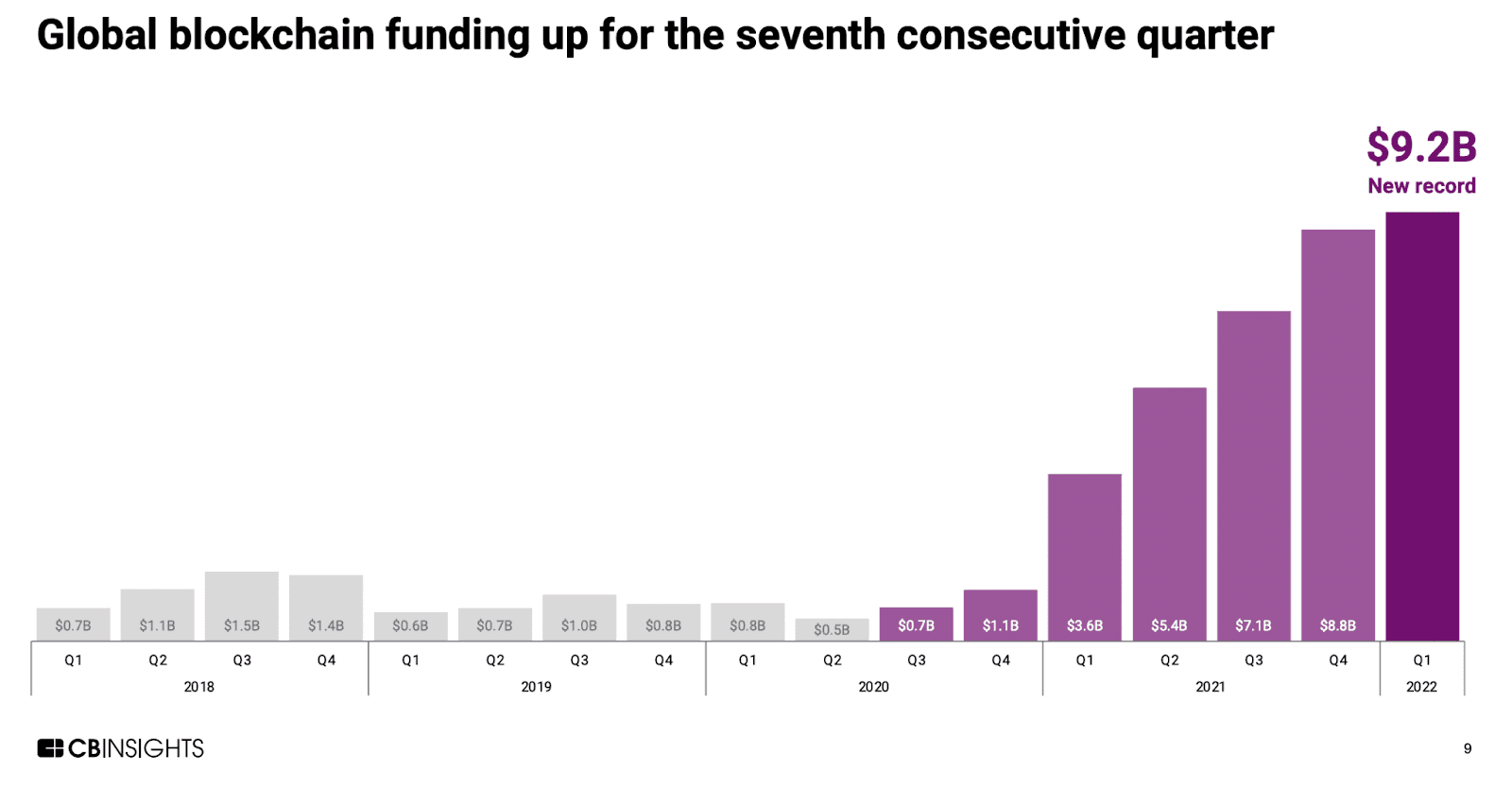

VC funding for crypto startups grew in Q1’22 for the 7th quarter.

The pullback in crypto prices have some fund managers feeling skeptical. But those who are in it for the long haul (aka: HODLers) will continue to allocate to early stage crypto startups.

“Venture funding to blockchain startups grew for the 7th straight quarter. While most other sectors saw Q1’22 declines due to lackluster public markets and an unsteady economy, VCs doubled down on blockchain and crypto. Web3, including NFTs and DeFi, was the biggest driver of growth.” (CB insights

So what does this mean for private markets?

Even though public markets face uncertainty, it's unlikely that VC activity will slow down completely, as there are billions in dry powder yet to be deployed. Valuations and deal sizes may normalize, but Founders will still build and raise and deals will still be done.

LPs will lean on SPVs as more opportunities arise.

Investors and Fund Managers are usually adaptive to such markets and find flexible and opportunistic ways to back the Founders and startups they believe in.

SPVs act as an extremely flexible tool, for such emerging managers and their investors, to raise and invest in opportunities on a deal-by-deal basis.

We predict:

Total new SPVs will increase as more opportunities arise

Secondary SPV demand will increase

Micro- fund and SPV demand will increase

LP preference will shift more towards SPVs than Funds

We’ve built Allocations with the mission to democratize private equity. Thousands of investors and fund managers have built SPVs and funds on Allocations.

Join these innovative fund managers on Allocations today.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

In Q1 of 2022, US VCs raised at an unparalleled rate. According to Pitchbook, more money was raised for new funds in this quarter than in the entirety of 2019.

However, this significant fundraising doesn’t exactly line up with the number of VC investments. We’ve seen a significant decrease in VC investments in Q1 of 2022. So while LPs may be slowing down, VC investments are expected to remain relatively stable due to the record-high amount of dry powder the market has ever seen.

Public market trends have historically been a good indicator of venture activity. Because of that, some believe VCs may face headwinds given the current movement of public markets.

But we predict that VCs, solo capitalists and angel investors will find opportunities in these 3 areas:

Microfunds & SPVs

Seed Deals & Secondary SPVs

Crypto

Micro-funds continue to be a rapidly growing vehicle.

The number of microfunds closed has grown from a tepid average of 75 per year between 2006 and 20011 to 320 between 2018 and 2020. And a record 339 micro-funds were closed in 2021.

Fund managers and solo capitalists use micro-funds and SPVs as a vehicle to adapt to the changing landscape and access new markets faster than ever. So as public markets remain in uncertainty, we expect to see even more fund managers take advantage of micro-funds and SPVs.

This April, Pitchbook released a report analyzing micro-funds and the direction they are trending:

“Despite the growing divide between micro-funds and the vehicles that drive the majority of venture fundraising in the US, these smaller vehicles have continued to drive trends from the beginnings of venture, and we believe they will continue to do so. Not only do they provide capital to the youngest companies, but they also offer benefits to the industry that larger funds cannot.”

SPVs and micro-funds create opportunities for solo capitalists and emerging VCs, providing access to more deals and allowing diversification.

“Micro-funds continue to proliferate in venture because, in many ways, they help democratize VC. Whether it be through increased opportunities to access the investment strategy, raise capital, or grow an investment firm or VC ecosystem, micro-funds offer keys to many.”

Historically, micro-funds and SPVs are most often raised by emerging managers. (Typically 60% of micro-funds—and in some years, more than 75%—are raised by emerging managers). But since 2011, we’ve seen a steady uptick in more established managers raising micro funds and SPVs.

However, it’s not only fund managers and investors who benefit from these smaller vehicles. There is a huge upside for founders and startups as well.

How are founders benefitting from SPVs?

Given that SPVs increase access to investors of all sizes, Founders are able to:

Invite small-check investors

Maintain their cap table in an efficient manner

Take the lead in ‘rolling-up’ their investors into an SPV

For example, Clubhouse in its recent Series B announcement, shared that it has over 180 investors in the company - many of which are small, independent investors that fit on a single-line on their cap table).

Micro-funds and SPVs often are most impactful at the seed stage- it allows emerging fund managers to engage more actively with founders while also diversifying.

It's important to note the strong correlation between micro-funds and seed deals. And in 2022, we are continuing to see VCs pour capital into seed stage deals.

With angel and seed stage companies being furthest away from public markets, it’s likely there will be a high level of activity in early stage deals.

According to CB Insights early-stage deals continue to account for the majority of deals (60%) in 2022 YTD.

With the heavy focus on seed / angel investments, SPVs will help fund managers get deals done quickly in these early stage investments. Founders move quickly, especially when the company is at the seed stage of funding. Angel groups and fund managers will lean on SPVs to keep up and avoid missing out on deals.

Large VCs have already started to allocate a portion of their capital to seed deals. In 2021, Andressen Horowitz raised a $400M fund specifically for seed deals and Greylock announced a $500M fund dedicated to seed investing.

“We are seeing later-stage firms move earlier as they recognize the opportunity in seed.” says Sarah Hodges, a partner at Pillar VC.

Fund managers will also likely look to secondary SPVs. This is where investors purchase existing shares from current shareholders in a company.

Why would shareholders sell early?

With the public markets unstable, many private companies will likely remain private longer than expected. Shareholders who are looking to liquidate quickly can do so though secondaries.This creates a valuable opportunity for fund managers and investors to invest in companies they may have previously missed the opportunity on.

And of course, it would be impossible to discuss the trends of 2022 without mentioning crypto.

We’ve already seen VC firms increasingly back more crypto projects, and especially with institutional adoption of crypto on the rise, we expect to see fundraising for crypto startups continue to grow.

VC funding for crypto startups grew in Q1’22 for the 7th quarter.

The pullback in crypto prices have some fund managers feeling skeptical. But those who are in it for the long haul (aka: HODLers) will continue to allocate to early stage crypto startups.

“Venture funding to blockchain startups grew for the 7th straight quarter. While most other sectors saw Q1’22 declines due to lackluster public markets and an unsteady economy, VCs doubled down on blockchain and crypto. Web3, including NFTs and DeFi, was the biggest driver of growth.” (CB insights

So what does this mean for private markets?

Even though public markets face uncertainty, it's unlikely that VC activity will slow down completely, as there are billions in dry powder yet to be deployed. Valuations and deal sizes may normalize, but Founders will still build and raise and deals will still be done.

LPs will lean on SPVs as more opportunities arise.

Investors and Fund Managers are usually adaptive to such markets and find flexible and opportunistic ways to back the Founders and startups they believe in.

SPVs act as an extremely flexible tool, for such emerging managers and their investors, to raise and invest in opportunities on a deal-by-deal basis.

We predict:

Total new SPVs will increase as more opportunities arise

Secondary SPV demand will increase

Micro- fund and SPV demand will increase

LP preference will shift more towards SPVs than Funds

We’ve built Allocations with the mission to democratize private equity. Thousands of investors and fund managers have built SPVs and funds on Allocations.

Join these innovative fund managers on Allocations today.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

In Q1 of 2022, US VCs raised at an unparalleled rate. According to Pitchbook, more money was raised for new funds in this quarter than in the entirety of 2019.

However, this significant fundraising doesn’t exactly line up with the number of VC investments. We’ve seen a significant decrease in VC investments in Q1 of 2022. So while LPs may be slowing down, VC investments are expected to remain relatively stable due to the record-high amount of dry powder the market has ever seen.

Public market trends have historically been a good indicator of venture activity. Because of that, some believe VCs may face headwinds given the current movement of public markets.

But we predict that VCs, solo capitalists and angel investors will find opportunities in these 3 areas:

Microfunds & SPVs

Seed Deals & Secondary SPVs

Crypto

Micro-funds continue to be a rapidly growing vehicle.

The number of microfunds closed has grown from a tepid average of 75 per year between 2006 and 20011 to 320 between 2018 and 2020. And a record 339 micro-funds were closed in 2021.

Fund managers and solo capitalists use micro-funds and SPVs as a vehicle to adapt to the changing landscape and access new markets faster than ever. So as public markets remain in uncertainty, we expect to see even more fund managers take advantage of micro-funds and SPVs.

This April, Pitchbook released a report analyzing micro-funds and the direction they are trending:

“Despite the growing divide between micro-funds and the vehicles that drive the majority of venture fundraising in the US, these smaller vehicles have continued to drive trends from the beginnings of venture, and we believe they will continue to do so. Not only do they provide capital to the youngest companies, but they also offer benefits to the industry that larger funds cannot.”

SPVs and micro-funds create opportunities for solo capitalists and emerging VCs, providing access to more deals and allowing diversification.

“Micro-funds continue to proliferate in venture because, in many ways, they help democratize VC. Whether it be through increased opportunities to access the investment strategy, raise capital, or grow an investment firm or VC ecosystem, micro-funds offer keys to many.”

Historically, micro-funds and SPVs are most often raised by emerging managers. (Typically 60% of micro-funds—and in some years, more than 75%—are raised by emerging managers). But since 2011, we’ve seen a steady uptick in more established managers raising micro funds and SPVs.

However, it’s not only fund managers and investors who benefit from these smaller vehicles. There is a huge upside for founders and startups as well.

How are founders benefitting from SPVs?

Given that SPVs increase access to investors of all sizes, Founders are able to:

Invite small-check investors

Maintain their cap table in an efficient manner

Take the lead in ‘rolling-up’ their investors into an SPV

For example, Clubhouse in its recent Series B announcement, shared that it has over 180 investors in the company - many of which are small, independent investors that fit on a single-line on their cap table).

Micro-funds and SPVs often are most impactful at the seed stage- it allows emerging fund managers to engage more actively with founders while also diversifying.

It's important to note the strong correlation between micro-funds and seed deals. And in 2022, we are continuing to see VCs pour capital into seed stage deals.

With angel and seed stage companies being furthest away from public markets, it’s likely there will be a high level of activity in early stage deals.

According to CB Insights early-stage deals continue to account for the majority of deals (60%) in 2022 YTD.

With the heavy focus on seed / angel investments, SPVs will help fund managers get deals done quickly in these early stage investments. Founders move quickly, especially when the company is at the seed stage of funding. Angel groups and fund managers will lean on SPVs to keep up and avoid missing out on deals.

Large VCs have already started to allocate a portion of their capital to seed deals. In 2021, Andressen Horowitz raised a $400M fund specifically for seed deals and Greylock announced a $500M fund dedicated to seed investing.

“We are seeing later-stage firms move earlier as they recognize the opportunity in seed.” says Sarah Hodges, a partner at Pillar VC.

Fund managers will also likely look to secondary SPVs. This is where investors purchase existing shares from current shareholders in a company.

Why would shareholders sell early?

With the public markets unstable, many private companies will likely remain private longer than expected. Shareholders who are looking to liquidate quickly can do so though secondaries.This creates a valuable opportunity for fund managers and investors to invest in companies they may have previously missed the opportunity on.

And of course, it would be impossible to discuss the trends of 2022 without mentioning crypto.

We’ve already seen VC firms increasingly back more crypto projects, and especially with institutional adoption of crypto on the rise, we expect to see fundraising for crypto startups continue to grow.

VC funding for crypto startups grew in Q1’22 for the 7th quarter.

The pullback in crypto prices have some fund managers feeling skeptical. But those who are in it for the long haul (aka: HODLers) will continue to allocate to early stage crypto startups.

“Venture funding to blockchain startups grew for the 7th straight quarter. While most other sectors saw Q1’22 declines due to lackluster public markets and an unsteady economy, VCs doubled down on blockchain and crypto. Web3, including NFTs and DeFi, was the biggest driver of growth.” (CB insights

So what does this mean for private markets?

Even though public markets face uncertainty, it's unlikely that VC activity will slow down completely, as there are billions in dry powder yet to be deployed. Valuations and deal sizes may normalize, but Founders will still build and raise and deals will still be done.

LPs will lean on SPVs as more opportunities arise.

Investors and Fund Managers are usually adaptive to such markets and find flexible and opportunistic ways to back the Founders and startups they believe in.

SPVs act as an extremely flexible tool, for such emerging managers and their investors, to raise and invest in opportunities on a deal-by-deal basis.

We predict:

Total new SPVs will increase as more opportunities arise

Secondary SPV demand will increase

Micro- fund and SPV demand will increase

LP preference will shift more towards SPVs than Funds

We’ve built Allocations with the mission to democratize private equity. Thousands of investors and fund managers have built SPVs and funds on Allocations.

Join these innovative fund managers on Allocations today.

Disclaimer: The information provided in this document does not, and is not intended to, constitute legal, tax, investment, or accounting advice; instead, all information, content, and materials available are for general informational or educational purposes only and it represents the personal view of the author. Please consult with your own legal, accounting or tax professionals.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast-moving fund managers

Why Allocations is the best choice for fast-moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc